For the 24 hours to 23:00 GMT, the GBP declined 0.26% against the USD and closed at 1.3184, after UK’s final Markit manufacturing PMI declined to a level of 48.2 in July, touching its lowest level since 2013, thus adding further evidence of a slowing economy and prompting the Bank of England to inject additional stimulus to revive growth. Markets expected the index to fall to a level of 49.1, following a level of 52.1 in the prior month.

In the Asian session, at GMT0300, the pair is trading at 1.319, with the GBP trading marginally higher against the USD from yesterday’s close.

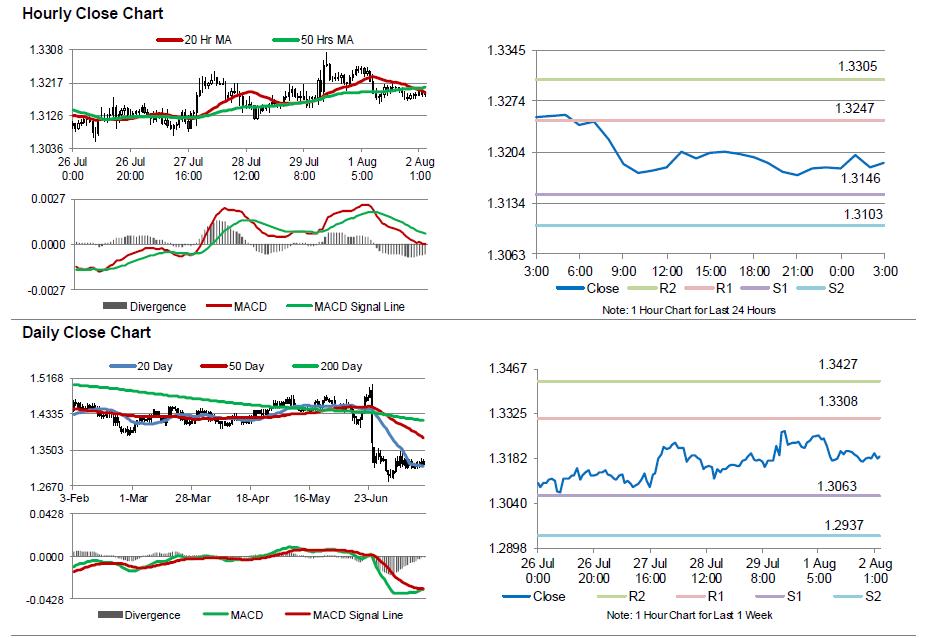

The pair is expected to find support at 1.3146, and a fall through could take it to the next support level of 1.3103. The pair is expected to find its first resistance at 1.3247, and a rise through could take it to the next resistance level of 1.3305.

Moving ahead, market participants would await the release of UK’s construction PMI for July, scheduled to release in a few hours.

The currency pair is showing convergence with its 20 Hr moving average and trading below its 50 Hr moving average.