For the 24 hours to 23:00 GMT, the GBP declined 0.76% against the USD and closed at 1.2370 on Friday, after an unexpected downturn in UK’s manufacturing, industrial and construction sector dented the nation’s growth prospects in the first-quarter of 2017.

Data revealed that Britain’s industrial production unexpectedly eased 0.7% on a monthly basis in February, defying market expectations for an advance of 0.2%. In the prior month, industrial production had registered a revised drop of 0.3%. Moreover, the nation’s manufacturing production surprisingly dropped 0.1% MoM in February, compared to a revised drop of 1.0% in the prior month, while market participants anticipated for a rise of 0.3%. Also, the nation’s construction output unexpectedly declined 1.7% in February, led by weakness in infrastructure activity and confounding market expectations for an advance of 0.1%. In the previous month, construction output had registered a revised flat reading.

Other economic data showed that total trade deficit in the UK surprisingly expanded to a level of £3.66 billion in February, triggered by a jump in imports of non-monetary gold and aircraft, whereas market expected the nation’s trade deficit to narrow down to a level of £2.20 billion. The nation had posted a revised deficit of £2.97 billion in the previous month. Moreover, the nation’s leading think tanker, NIESR estimated UK’s gross domestic product (GDP) rose less-than-expected by 0.5% in the January-March 2017 period, compared to a revised similar rise in the three months ended February. Meanwhile, markets expected for an expansion of 0.6%.

In the Asian session, at GMT0300, the pair is trading at 1.2375, with the GBP trading marginally higher against the USD from Friday’s close.

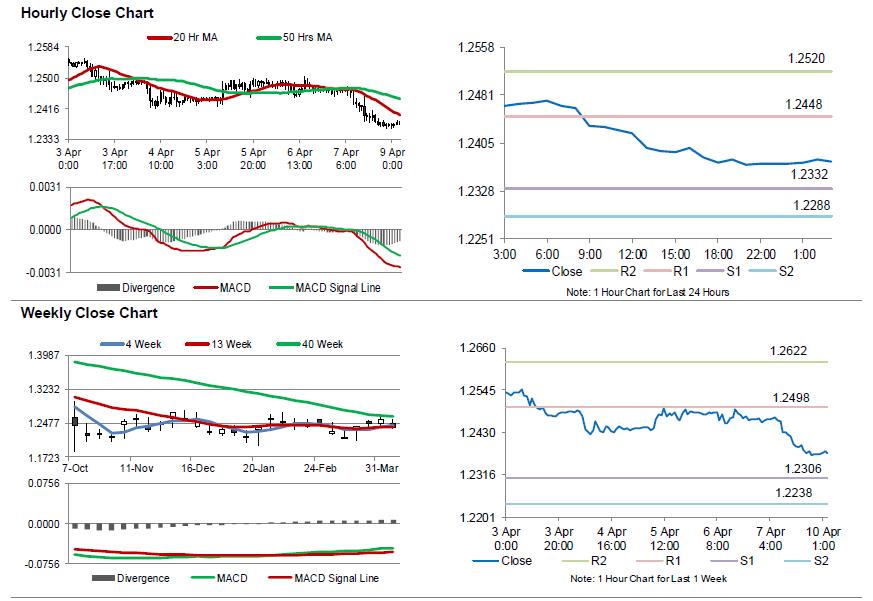

The pair is expected to find support at 1.2332, and a fall through could take it to the next support level of 1.2288. The pair is expected to find its first resistance at 1.2448, and a rise through could take it to the next resistance level of 1.252.

With no economic releases in UK today, investor sentiment will be governed by global macroeconomic factors.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.