For the 24 hours to 23:00 GMT, the GBP rose 0.13% against the USD and closed at 1.2666.

Data indicated that UK’s manufacturing PMI contracted to a level of 49.4 in May, declining to its lowest level since July 2016 and more than market consensus for a fall to a level of 52.2. The PMI had registered a reading of 53.1 in the prior month.

In the Asian session, at GMT0300, the pair is trading at 1.2667, with the GBP trading a tad higher against the USD from yesterday’s close.

Overnight data showed that Britain’s BRC retail sales across all sectors surprisingly fell 3.0% on an annual basis in May, falling at its quickest pace in 24 years and defying market anticipations for a rise of 0.8%. In the previous month, retail sales across all sectors had registered a climb of 3.7%.

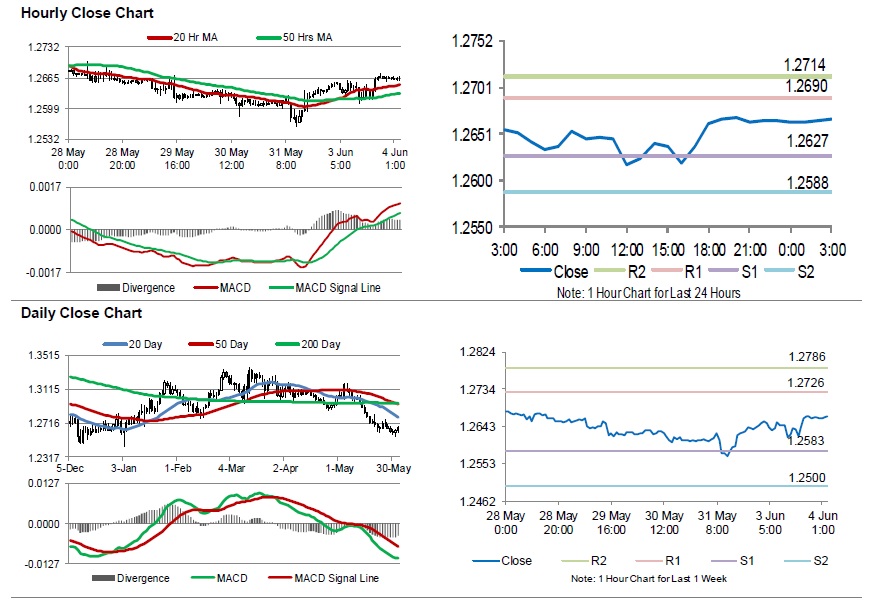

The pair is expected to find support at 1.2627, and a fall through could take it to the next support level of 1.2588. The pair is expected to find its first resistance at 1.2690, and a rise through could take it to the next resistance level of 1.2714.

Trading trend in the Sterling today, is expected to be determined by UK’s Markit/CIPS construction PMI for May, slated to release in a few hours.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.