For the 24 hours to 23:00 GMT, the GBP declined 0.34% against the USD and closed at 1.2726, amid continuing Brexit concerns.

Data indicated that UK’s manufacturing PMI advanced to a level of 53.1 in November, notching its highest level in two months and beating market expectations for a gain to a level of 51.7. In the prior month, the PMI had recorded a reading of 51.1.

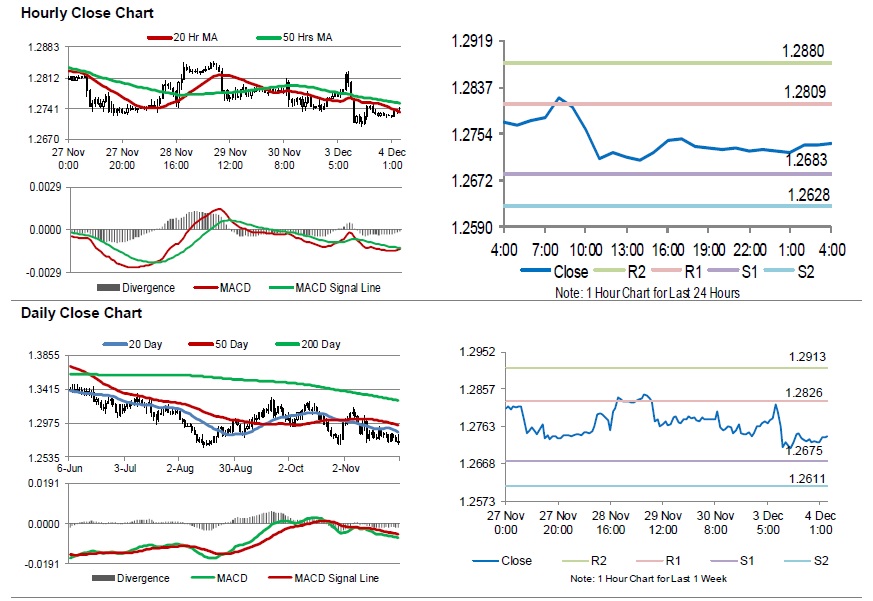

In the Asian session, at GMT0400, the pair is trading at 1.2738, with the GBP trading 0.09% higher against the USD from yesterday’s close.

The pair is expected to find support at 1.2683, and a fall through could take it to the next support level of 1.2628. The pair is expected to find its first resistance at 1.2809, and a rise through could take it to the next resistance level of 1.2880.

Looking ahead, investors would keep an eye on the Bank of England’s Governor, Mark Carney’s speech, due in a few hours. Additionally, Britain’s construction PMI for November, will also be on investors radar.

The currency pair is showing convergence with its 20 Hr moving average and trading below its 50 Hr moving average.