For the 24 hours to 23:00 GMT, the GBP rose 0.64% against the USD and closed at 1.2591, after Brexit Minister, David Davis, stated that Britain could secure access to the European Union’s trade market by paying for it, thus strengthening prospects of a softer Brexit.

In economic news, data showed that UK’s manufacturing PMI unexpectedly fell to a level of 53.4 in November, expanding at its slowest pace in four-months, compared to a revised level of 54.2 in the previous month. Market expectation was for the manufacturing PMI to climb to 54.3. Meanwhile, the nation’s seasonally adjusted Nationwide house prices advanced by 0.1% on a monthly basis in November, less than market expectations for a rise of 0.2% and following a flat reading in the previous month.

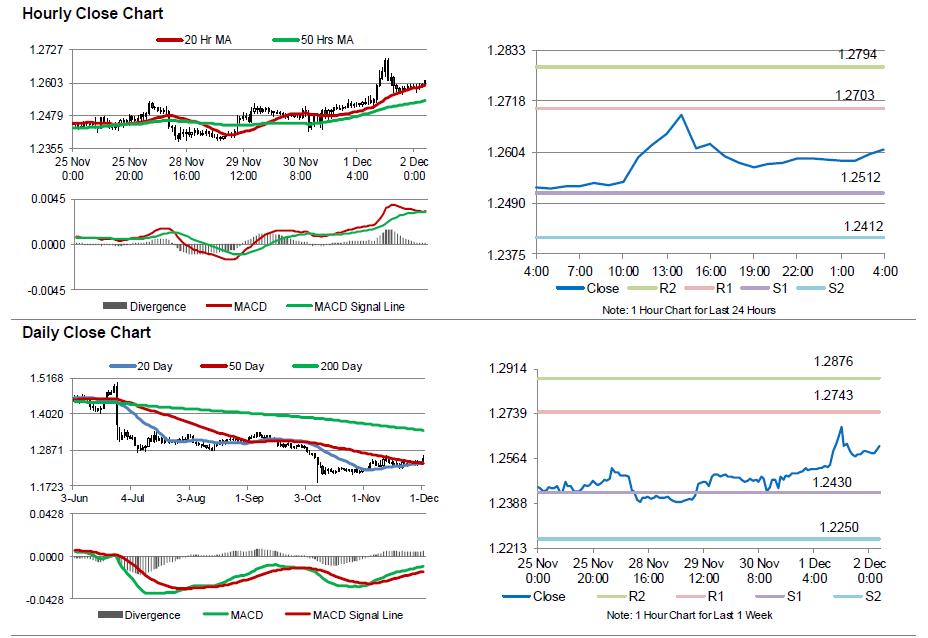

In the Asian session, at GMT0400, the pair is trading at 1.2611, with the GBP trading 0.16% higher against the USD from yesterday’s close.

The pair is expected to find support at 1.2512, and a fall through could take it to the next support level of 1.2412. The pair is expected to find its first resistance at 1.2703, and a rise through could take it to the next resistance level of 1.2794.

Investors would focus on UK’s Markit construction PMI for November, slated to release in a few hours.

The currency pair is showing convergence with its 20 Hr moving average and trading above its 50 Hr moving average.