For the 24 hours to 23:00 GMT, the GBP fell 0.16% against the USD and closed at 1.4711, after UK’s Markit manufacturing PMI unexpectedly declined to a 3-month low level of 51.9 in December, compared to market expectations of an advance to 52.8 and after recording a revised reading of 52.5 in the previous month, dampening optimism about the health of the UK economy.

On the other hand, the nation’s mortgage approvals surprisingly advanced to a 3-month high level of 70.4K in November, following a revised reading of 69.9K in the previous month and defying investor expectations for it to fall to a level of 69.8K. Additionally, net consumer credit in the UK rose more-than-anticipated by £1.5 billion in November, against market expectations for an advance of £1.3 billion and after rising by £1.2 billion in the prior month.

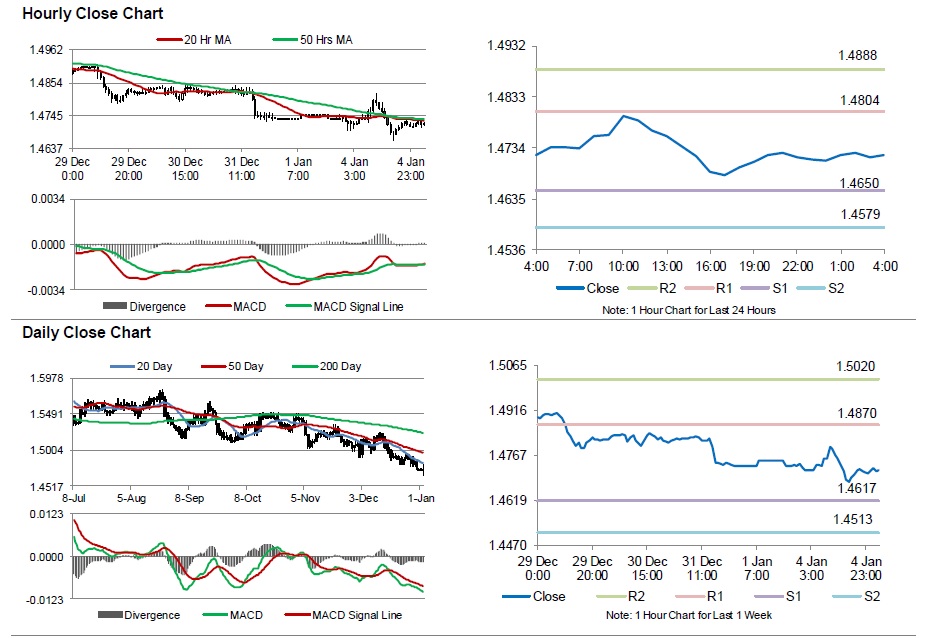

In the Asian session, at GMT0400, the pair is trading at 1.472, with the GBP trading 0.06% higher from yesterday’s close.

The pair is expected to find support at 1.4650, and a fall through could take it to the next support level of 1.4579. The pair is expected to find its first resistance at 1.4804, and a rise through could take it to the next resistance level of 1.4888.

Moving ahead, investors will concentrate on UK’s Markit construction PMI data for December, scheduled to be released in a few hours, for further cues.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.