For the 24 hours to 23:00 GMT, the GBP declined 0.76% against the USD and closed at 1.2454 on Friday.

On the data front, UK’s BBA mortgage approvals surprisingly surged to a twelve-month high level of 44.7K in January, as buyers sought to take advantage of record low interest rates. In the previous month, BBA mortgage approvals registered a revised reading of 43.6K, while investors had envisaged for a fall to a level of 42.6K.

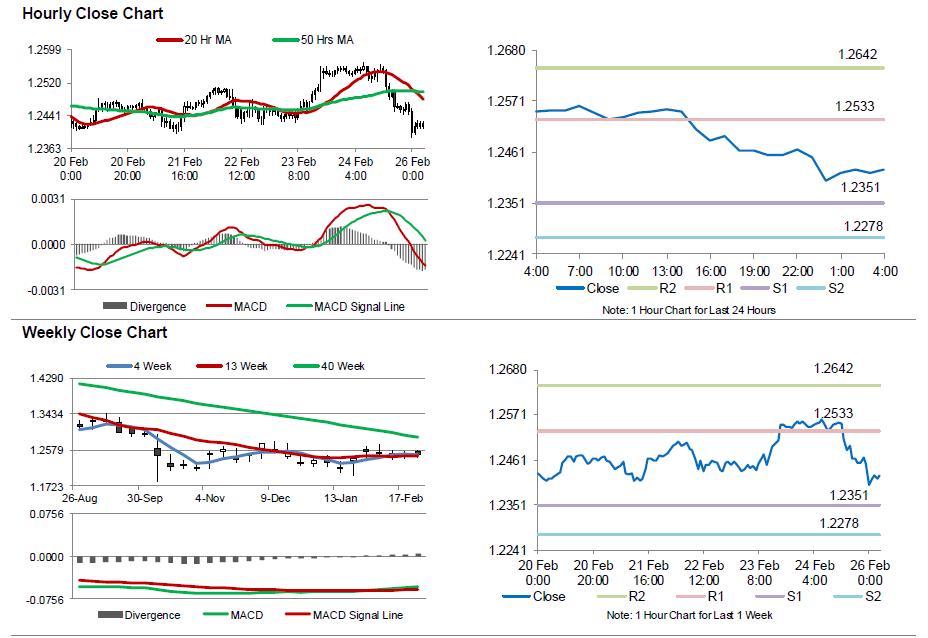

In the Asian session, at GMT0400, the pair is trading at 1.2423, with the GBP trading 0.25% lower against the USD from Friday’s close.

The pair is expected to find support at 1.2351, and a fall through could take it to the next support level of 1.2278. The pair is expected to find its first resistance at 1.2533, and a rise through could take it to the next resistance level of 1.2642.

Amid a lack of major economic releases in UK today, investor sentiment would be governed by global macroeconomic factors.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.