For the 24 hours to 23:00 GMT, the GBP declined 0.25% against the USD and closed at 1.2904.

Data showed that UK’s public sector net borrowing posted a deficit of £0.84 billion in March, marking its lowest level in 17-years and defying market consensus for a surplus of £0.40 billion. In the preceding month, the nation registered a revised surplus of £0.51 billion.

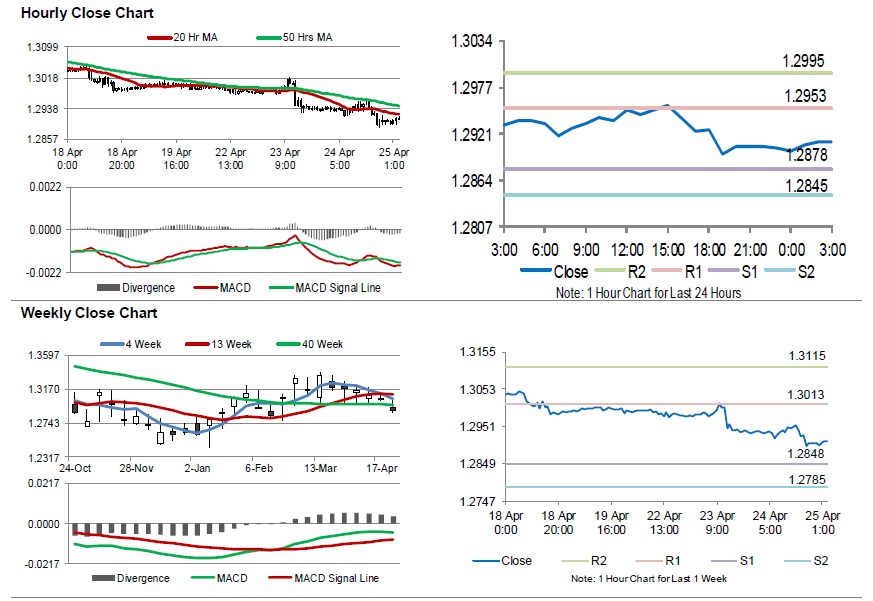

In the Asian session, at GMT0300, the pair is trading at 1.2910, with the GBP trading 0.05% higher against the USD from yesterday’s close.

The pair is expected to find support at 1.2878, and a fall through could take it to the next support level of 1.2845. The pair is expected to find its first resistance at 1.2953, and a rise through could take it to the next resistance level of 1.2995.

Moving ahead, traders would keep an eye on UK’s CBI trends total orders and CBI business optimism for April, set to release in a few hours.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.