For the 24 hours to 23:00 GMT, the GBP declined 0.57% against the USD and closed at 1.2890, after government’s proposed Brexit timetable was rejected by the UK lawmakers.

Data showed that UK’s public sector net borrowing deficit widened to £8.73 billion in September, following a revised deficit of £4.92 billion in the prior month. Markets had anticipated the nation to post a deficit of £8.70 billion.

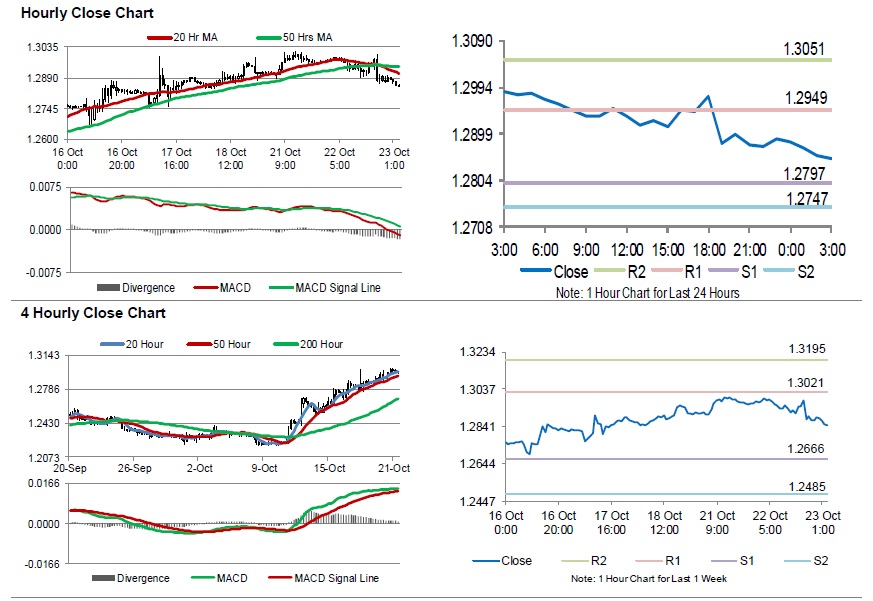

In the Asian session, at GMT0300, the pair is trading at 1.2848, with the GBP trading 0.33% lower against the USD from yesterday’s close.

The pair is expected to find support at 1.2797, and a fall through could take it to the next support level of 1.2747. The pair is expected to find its first resistance at 1.2949, and a rise through could take it to the next resistance level of 1.3051.

Trading trend in the Sterling today, is expected to be determined by UK’s BBA mortgage approvals for September, set to release in a few hours.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.