For the 24 hours to 23:00 GMT, the GBP rose 0.45% against the USD and closed at 1.2491, after the Supreme Court ruled that Prime Minister, Boris Johnson’s decision to suspend Parliament was unlawful.

In economic news, UK’s public sector net borrowing recorded a deficit of £5.8 billion in August, less than market expectations for a deficit of £6.7 billion and compared to a revised surplus of £1.5 billion in the same period last year. Also, the nation’s balance of firms reporting total order book above normal surprisingly dropped to a level of -28.0 in September, compared to a reading of -13.0 in the previous month. Market participants had anticipated the balance of firms reporting total order book above normal to record a steady reading.

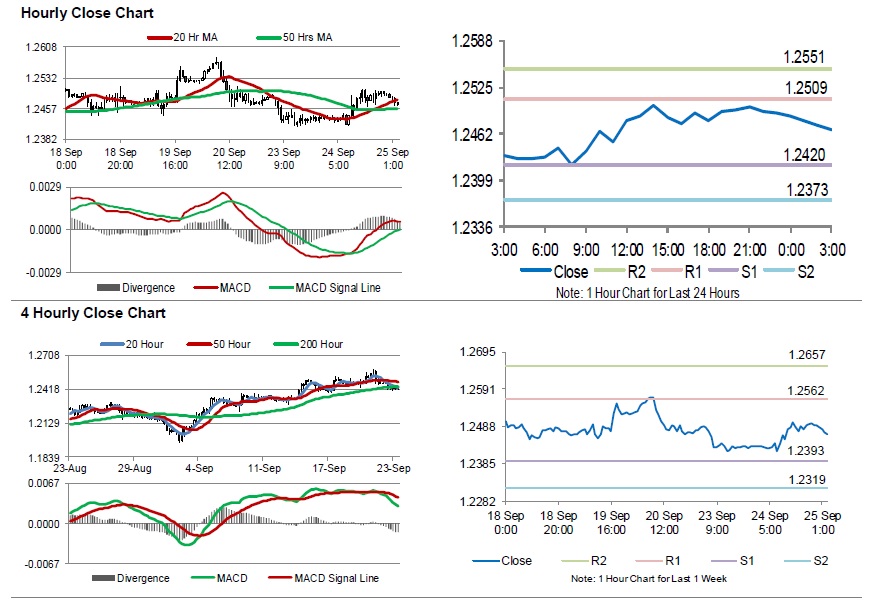

In the Asian session, at GMT0300, the pair is trading at 1.2468, with the GBP trading 0.18% lower against the USD from yesterday’s close.

The pair is expected to find support at 1.2420, and a fall through could take it to the next support level of 1.2373. The pair is expected to find its first resistance at 1.2509, and a rise through could take it to the next resistance level of 1.2551.

Trading trend in the Sterling today, is expected to be determined by UK’s BBA mortgage approvals for August, set to release in a few hours.

The currency pair is showing convergence with its 20 Hr moving average and trading above its 50 Hr moving average.