For the 24 hours to 23:00 GMT, the GBP rose 0.15% against the USD and closed at 1.4355, after retail sales in the UK bounced back last month.

Data showed that UK’s retail sales rose more-than-expected and jumped the most in more than two years by 2.3% MoM in January, led by demand for clothing and computers. Markets expected it to increase by 0.8%, from a revised drop of 1.4% in the preceding month. Meanwhile, the public sector net borrowing in the UK reported a surplus £11.80 billion in January, in the UK, from a revised deficit of £7.50 billion in the previous month. Markets were expecting public sector net borrowing to post a surplus of £13.90 billion.

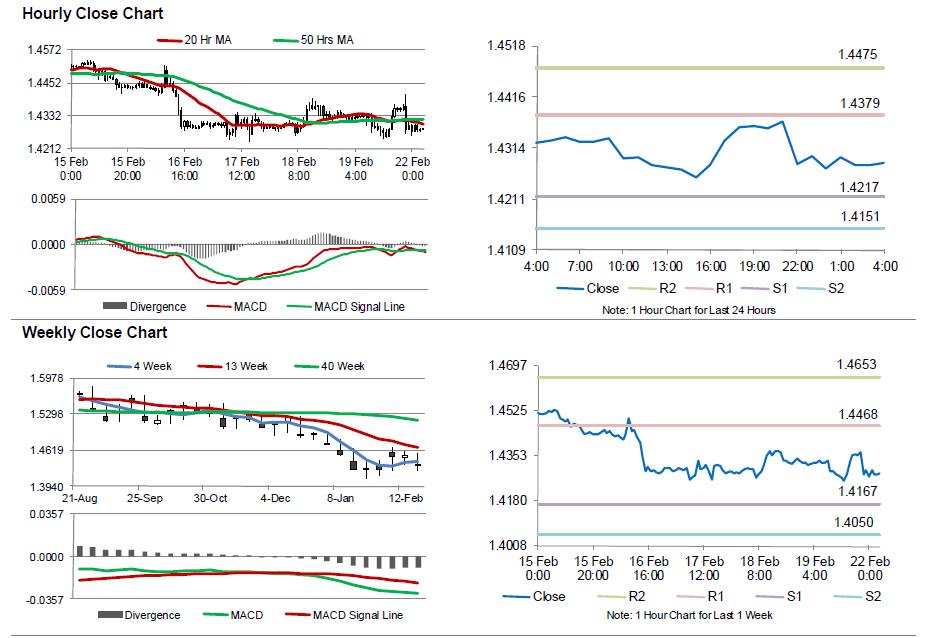

In the Asian session, at GMT0400, the pair is trading at 1.4283, with the GBP trading 0.5% lower from Friday’s close.

The pair is expected to find support at 1.4217, and a fall through could take it to the next support level of 1.4151. The pair is expected to find its first resistance at 1.4379, and a rise through could take it to the next resistance level of 1.4475.

Looking ahead, market participants will keep a close watch on UK’s BBA mortgage approval data, set to release on Wednesday.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.