For the 24 hours to 23:00 GMT, the GBP declined 0.09% against the USD and closed at 1.3328, after UK’s final Markit services PMI eased to a level of 47.4 in July, in line with market expectations, contracting for the first time in more than three years in July, highlighting that the nation is facing renewed downside pressure in the wake of Brexit vote. The index had registered a reading of 52.3 in the prior month.

In the Asian session, at GMT0300, the pair is trading at 1.3340, with the GBP trading 0.09% higher against the USD from yesterday’s close.

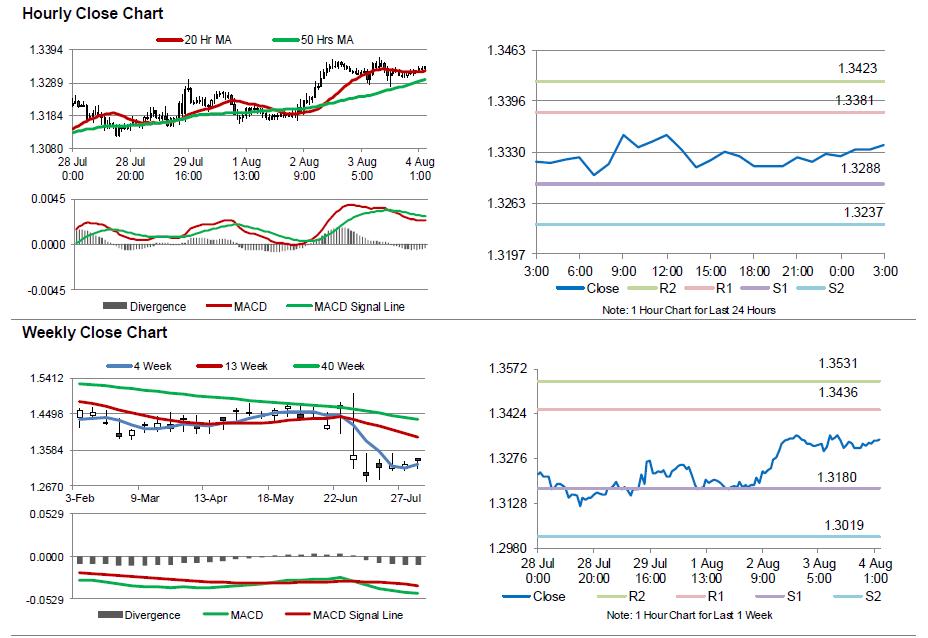

The pair is expected to find support at 1.3288, and a fall through could take it to the next support level of 1.3237. The pair is expected to find its first resistance at 1.3381, and a rise through could take it to the next resistance level of 1.3423.

Going ahead, investors would closely monitor BoE’s interest rate decision, due in a few hours. Markets widely expect that the central bank would cut its rate this time.

The currency pair is showing convergence with its 20 Hr moving average and trading above its 50 Hr moving average.