For the 24 hours to 23:00 GMT, the GBP rose 1.13% against the USD and closed at 1.2288, after UK’s ILO unemployment rate surprisingly dropped to 4.7% in the November-January 2017 period, reaching its lowest level since 1975, while markets anticipated it to remain steady at 4.8%.

However, the nation’s average earnings including bonus advanced less-than-expected by 2.2% on an annual basis in the three months ended January, underlining concerns that consumer spending will be eroded as inflation rises and making it more unlikely that the Bank of England will hike interest rates in the near term. Investors had envisaged average earnings to rise 2.4%, following a gain of 2.6% in the October-December 2016 period.

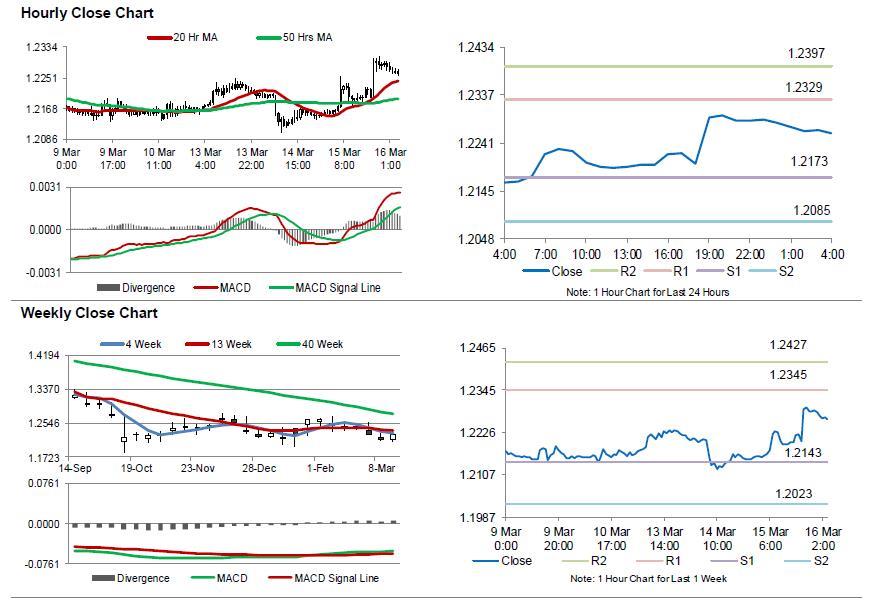

In the Asian session, at GMT0400, the pair is trading at 1.2262, with the GBP trading 0.21% lower against the USD from yesterday’s close.

The pair is expected to find support at 1.2173, and a fall through could take it to the next support level of 1.2085. The pair is expected to find its first resistance at 1.2329, and a rise through could take it to the next resistance level of 1.2397.

Trading trends in the GBP today are expected to be determined by the Bank of England’s interest rate decision, scheduled later today. Markets broadly expect the central bank to keep monetary policy unchanged.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.