For the 24 hours to 23:00 GMT, the GBP declined 0.24% against the USD and closed at 1.3075 amid weak inflation figures.

In the economic news, UK’s consumer price index climbed 2.4% on an annual basis in June, marking its slowest pace in 14 months, falling short of market expectations for a rise of 2.6%. The index had registered a similar rise in the previous month. Moreover, non-seasonally adjusted output producer price index rose 3.1% on an annual basis in June, less than market expectations for an advance of 3.2%. In the prior month, output producer price index had registered a revised rise of 3.0%. Further, the nation’s retail price index increased 3.4% on monthly basis in June, compared to an advance of 3.3% in the prior month. Market participants had envisaged the index to rise 3.5%. Additionally, UK’s house price index jumped 3.0% on yearly basis in May, rising at its weakest pace in 5-years, while market consensus was for an advance of 3.7%. In the preceding month, the index had recorded a revised gain of 3.5%.

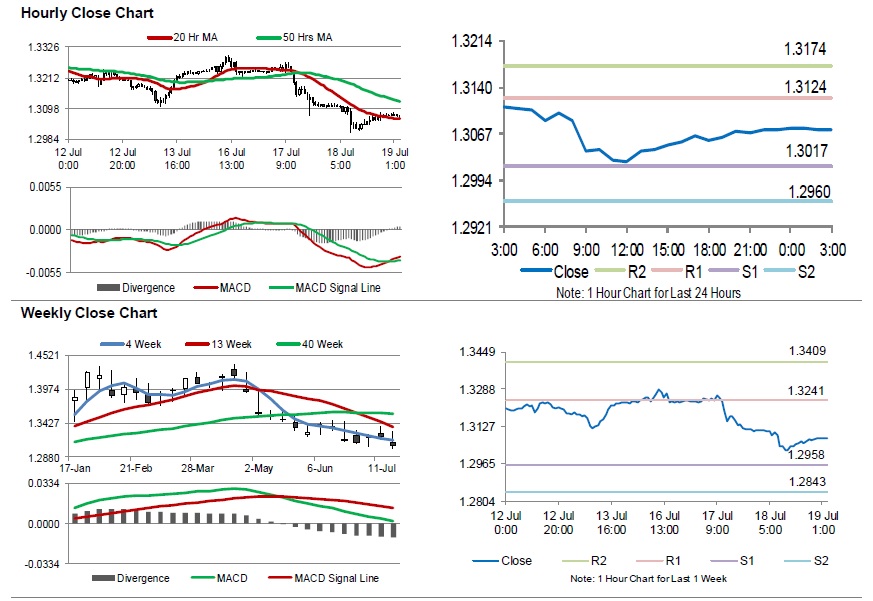

In the Asian session, at GMT0300, the pair is trading at 1.3074, with the GBP trading slightly lower against the USD from yesterday’s close.

The pair is expected to find support at 1.3017, and a fall through could take it to the next support level of 1.2960. The pair is expected to find its first resistance at 1.3124, and a rise through could take it to the next resistance level of 1.3174.

Going ahead, traders would focus on UK’s retail sales data for June, due to release in a few hours.

The currency pair is showing convergence with its 20 Hr moving average and trading below its 50 Hr moving average.