For the 24 hours to 23:00 GMT, the USD declined 0.69% against the CAD and closed at 1.3507.

On the data front, Canada’s manufacturing sales jumped 10.7% on a monthly basis in May, beating market expectations for a rise of 9.5% and compared to a revised plunge of 27.9% in the previous month.

The Bank of Canada (BoC), in its interest rate decision, kept its key interest rate unchanged at 0.25%, as widely expected and indicated that rates would remain low until the national economic picture improves. Moreover, the bank expects the economy to contract by 7.8% this year and expects growth of 5.1% in 2021. On the outlook front, the central bank expects partial economic bounceback from the lifting of lockdowns.

In the Asian session, at GMT0300, the pair is trading at 1.3510, with the USD trading marginally higher against the CAD from yesterday’s close.

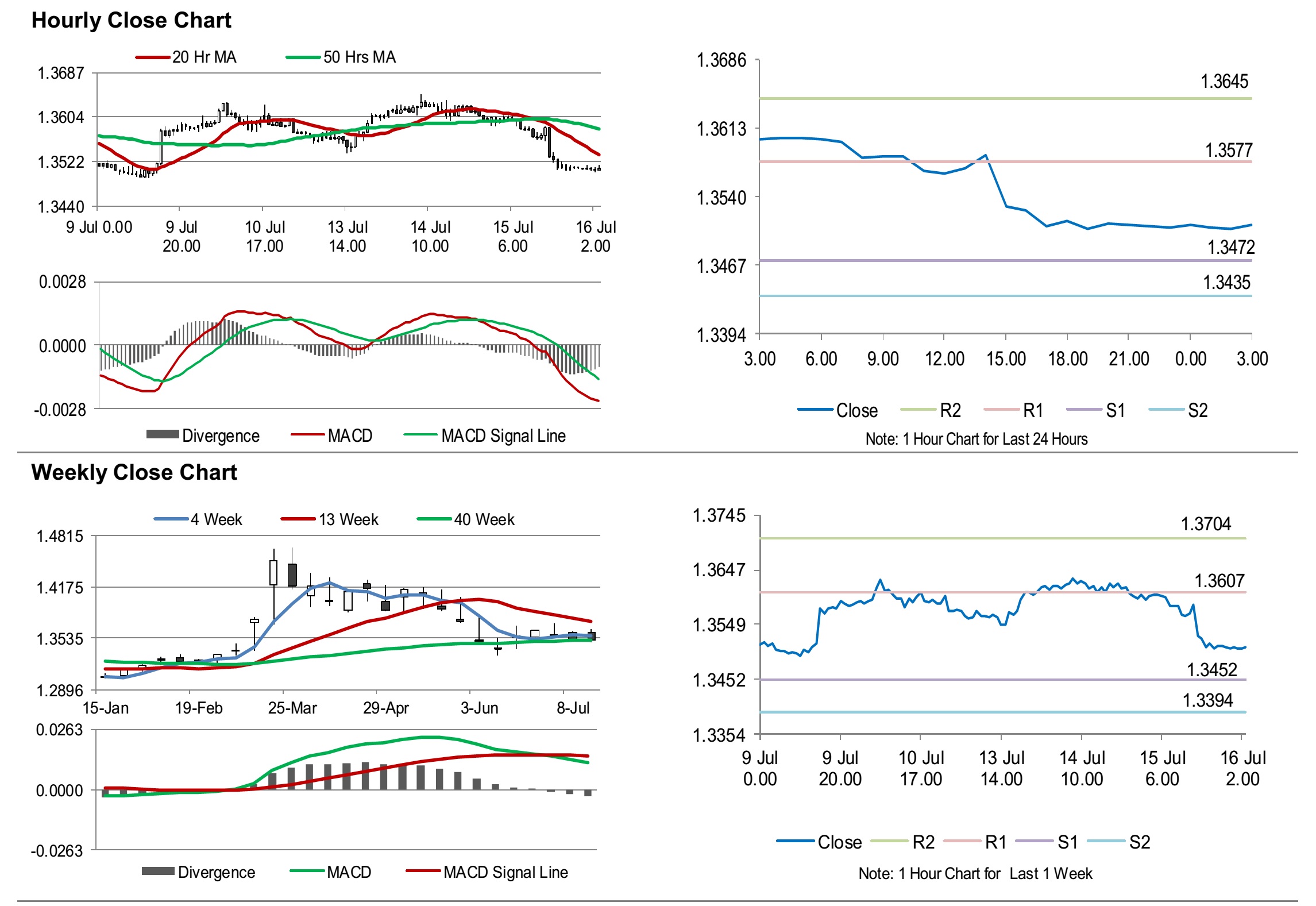

The pair is expected to find support at 1.3472, and a fall through could take it to the next support level of 1.3435. The pair is expected to find its first resistance at 1.3577, and a rise through could take it to the next resistance level of 1.3645.

Moving ahead, traders would keep a watch on Canada’s ADP employment change for June, slated to release later today.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.