For the 24 hours to 23:00 GMT, the USD rose 1.71% against the CAD and closed at 1.3266.

Yesterday, the Bank of Canada (BoC), opted to leave the benchmark interest rate unchanged at 0.5%, as widely expected. In a post-meeting statement, the BoC Governor, Stephen Poloz warned that an interest rate cut remains in play, if downside risks from a much more protectionist United States under the President-elect Donald Trump materialises. Additionally, the central bank released its Monetary Policy Report that sets out its latest forecasts for Canada’s economic growth. The bank predicts Canada’s economy to grow by 2.1% in each of 2017 and 2018 and that it would return to full capacity around mid-2018.

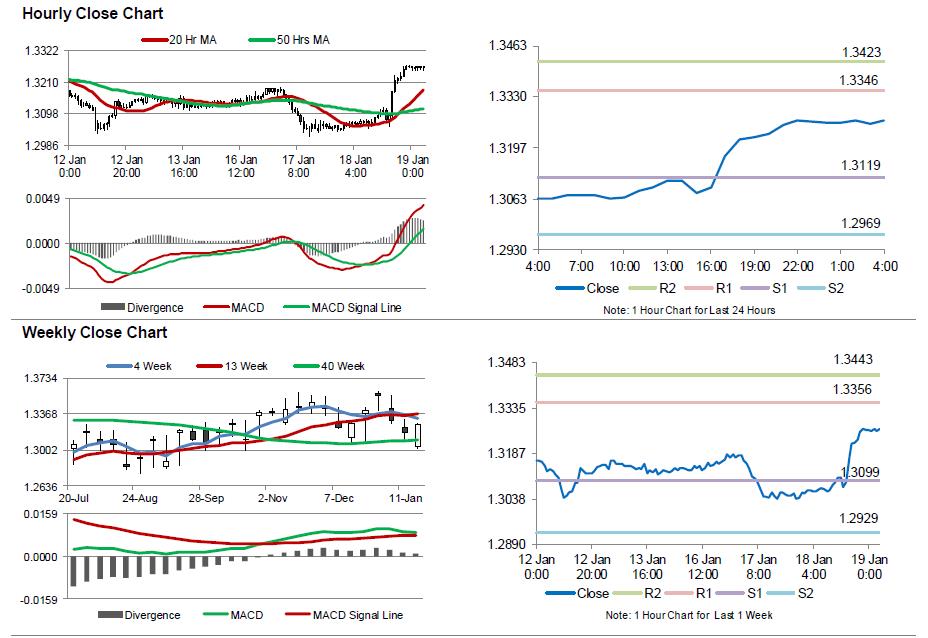

In the Asian session, at GMT0400, the pair is trading at 1.3269, with the USD trading slightly higher against the CAD from yesterday’s close.

The pair is expected to find support at 1.3119, and a fall through could take it to the next support level of 1.2969. The pair is expected to find its first resistance at 1.3346, and a rise through could take it to the next resistance level of 1.3423.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.