For the 24 hours to 23:00 GMT, the USD rose 1.03% against the CAD and closed at 1.2802.

The Canadian Dollar lost ground, after the Bank of Canada (BoC), at its latest monetary policy meeting, expressed caution on the prospects of future rate increases.

The BoC, as widely expected, opted to leave the benchmark interest rate unchanged at 1.00%, but suggested future increases are still likely, albeit at a more gradual pace. In its monetary policy statement, the central bank disclosed that it decided to hold interest rates as the recent strength of the Canadian dollar is expected to slow the pace of inflation. The central bank is now projecting inflation to rise to 2.0% a bit later in 2018 than previously expected and forecasted Canada’s economy to expand by 3.1% in 2017, 2.1% in 2018 and 1.5% in 2019.

In the Asian session, at GMT0300, the pair is trading at 1.2792, with the USD trading 0.08% lower against the CAD from yesterday’s close.

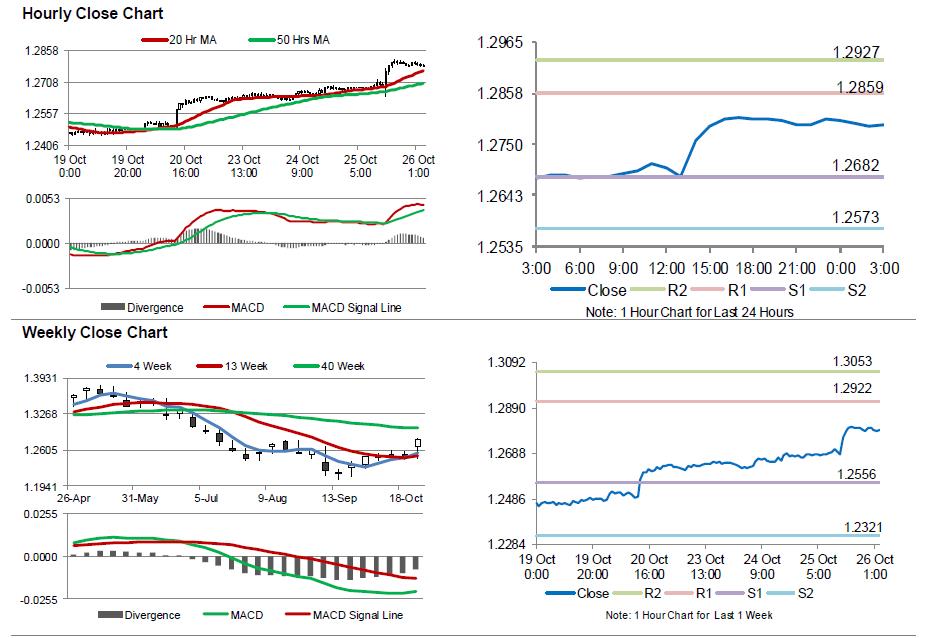

The pair is expected to find support at 1.2682, and a fall through could take it to the next support level of 1.2573. The pair is expected to find its first resistance at 1.2859, and a rise through could take it to the next resistance level of 1.2927.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.