For the 24 hours to 23:00 GMT, the USD rose 0.31% against the CAD to close at 1.0946, as the Canadian Dollar came under pressure after the Bank of Canada (BoC) kept its interest rate unchanged at 1.0% in June and blamed a hostile weather for the below-par performance of the domestic economy. Furthermore, the BoC policymakers expressed concerns over the impact of Canada’s soft economic growth on its inflation outlook while highlighting the need for a weaker loonie to boost growth in the nation’s export sector. Negative sentiment was also fuelled after Canada unexpectedly posted a trade deficit of C$0.64 billion in April following two months of surplus.

In the Asian session, at GMT0300, the pair is trading at 1.0948, with the USD trading a tad higher from yesterday’s close.

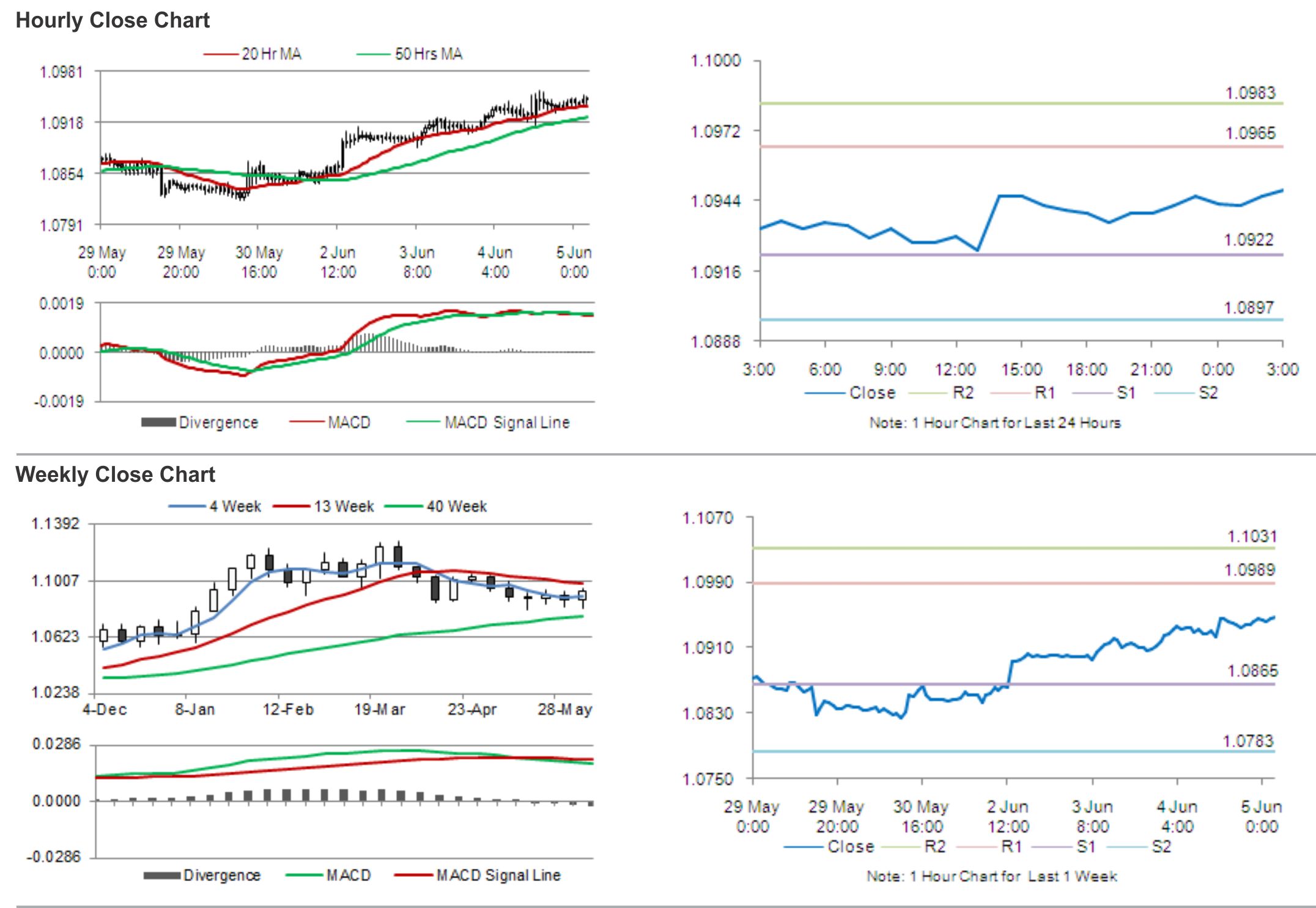

The pair is expected to find support at 1.0922, and a fall through could take it to the next support level of 1.0897. The pair is expected to find its first resistance at 1.0965, and a rise through could take it to the next resistance level of 1.0983.

During the later course of the day, traders would eye Canada’s building permits and the Ivey PMI data for further guidance in the loonie.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.