For the 24 hours to 23:00 GMT, the USD declined 0.75% against the CAD and closed at 1.3194.

The Bank of Canada (BoC), in its latest monetary policy meeting, left its key interest rate unchanged at 1.75%, as widely expected, amid signs of economic stability. Further, the central bank indicated that inflation consistently continues to remain near its 2% target. However, the BoC warned that the adverse impact of ongoing global trade disputes could harm the global economic growth.

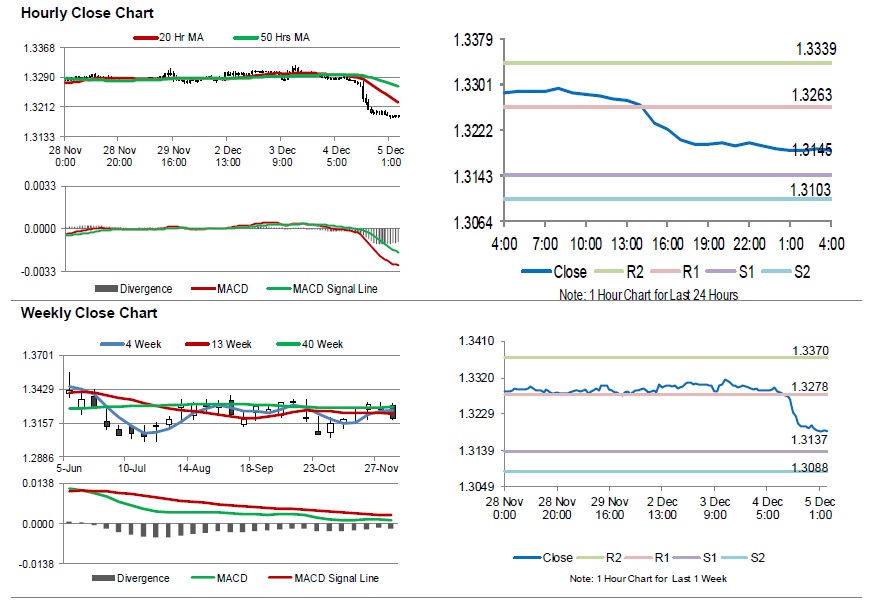

In the Asian session, at GMT0400, the pair is trading at 1.3186, with the USD trading 0.06% lower against the CAD from yesterday’s close.

The pair is expected to find support at 1.3145, and a fall through could take it to the next support level of 1.3103. The pair is expected to find its first resistance at 1.3263, and a rise through could take it to the next resistance level of 1.3339.

Trading trend in the Loonie today, is expected to be determined by Canada’s Ivey Purchasing Managers lndex for November, slated to release later in the day.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.