For the 24 hours to 23:00 GMT, the USD declined 0.39% against the CAD to close at 1.0930.

The Canadian Dollar gained ground, despite official reports revealing that the housing starts in Canada slipped to a seasonally adjusted annual rate of 156,800 in March while building permits in the nation fell to the lowest in a year in February.

In noteworthy event, the IMF upgraded its growth on Canada to 2.3% this year, but warned about the nation’s weaker than expected exports, high household debt loads and high house prices which would affect the economic outlook. Additionally, the IMF suggested the Bank of Canada (BoC) Governor Stephen Poloz to keep the central bank’s benchmark interest rate low for some more time until it does not sees strong signs of economic recovery in the nation.

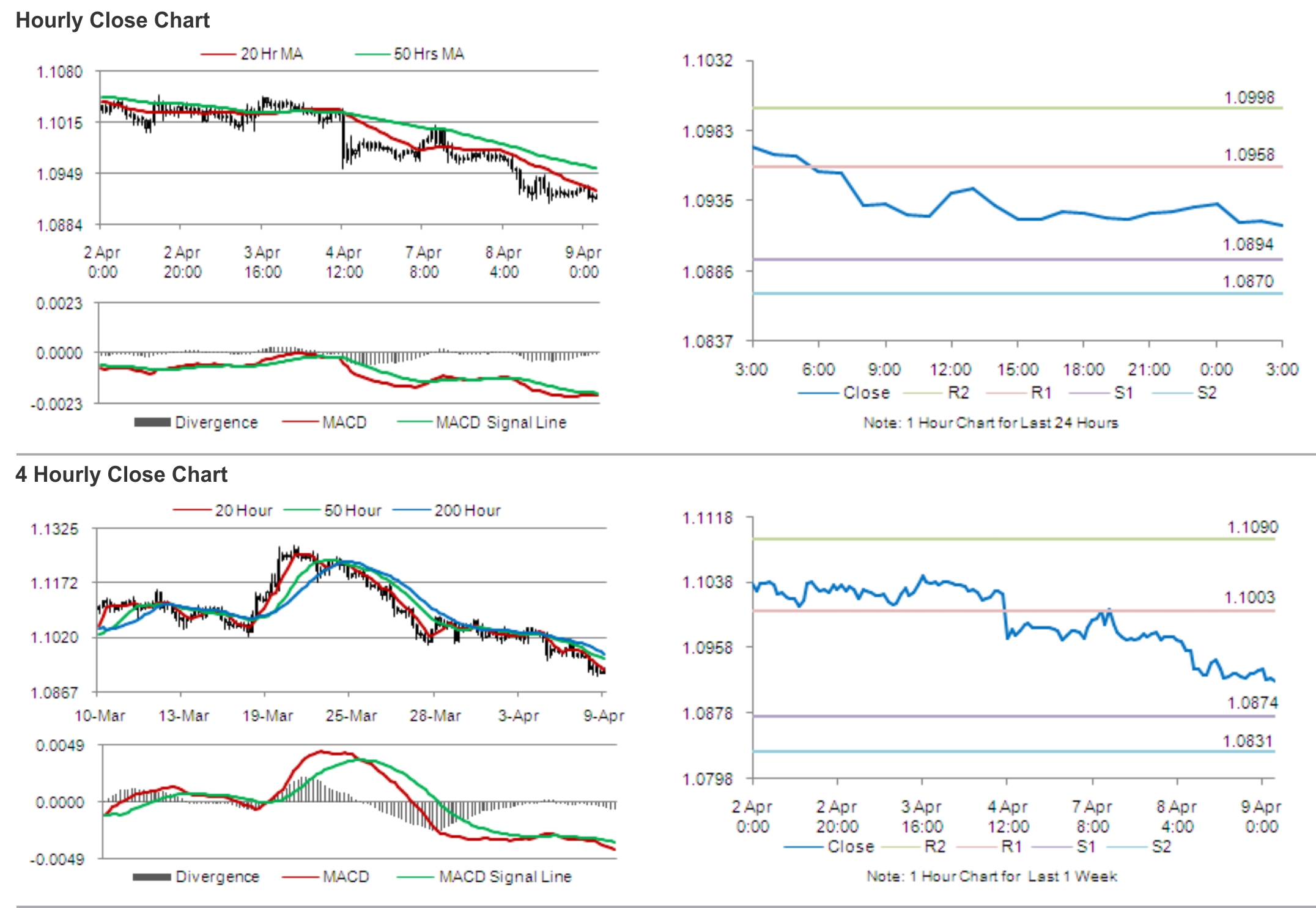

In the Asian session, at GMT0300, the pair is trading at 1.0917, with the USD trading 0.12% lower from yesterday’s close.

The pair is expected to find support at 1.0894, and a fall through could take it to the next support level of 1.0870. The pair is expected to find its first resistance at 1.0958, and a rise through could take it to the next resistance level of 1.0998.

With no major economic releases from Canada, traders are expected to eye global economic news for further guidance in the currency pair.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.