For the 24 hours to 23:00 GMT, the USD declined 0.07% against the CAD and closed at 1.2910.

Yesterday, the Bank of Canada (BoC), at its March monetary policy meeting, opted to keep the benchmark lending rate unchanged at 1.25%, as widely expected. In the post-meeting statement, the central bank noted that recent trade policy developments have clouded growth outlook for Canada as well as global economy. Nevertheless, the central bank described the current global growth momentum as positive and added that Canadian inflation was running close to its target, while wage growth has improved.

On the data front, Canada’s international merchandise trade deficit narrowed to C$1.91 billion in January, compared to a revised deficit of C$3.05 billion in the previous month. Markets were expecting the nation to record a trade deficit of C$2.50 billion.

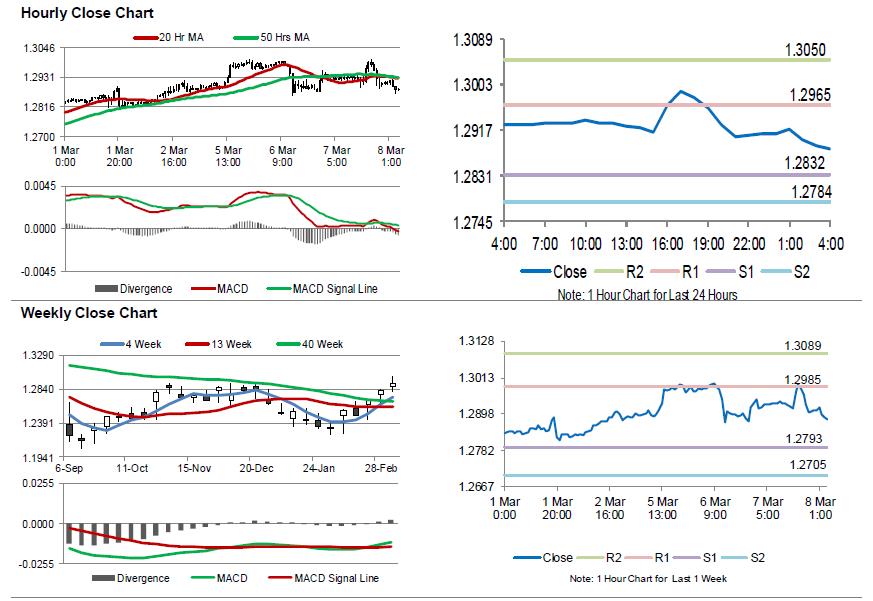

In the Asian session, at GMT0400, the pair is trading at 1.2881, with the USD trading 0.22% lower against the CAD from yesterday’s close.

The pair is expected to find support at 1.2832, and a fall through could take it to the next support level of 1.2784. The pair is expected to find its first resistance at 1.2965, and a rise through could take it to the next resistance level of 1.3050.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.