For the 24 hours to 23:00 GMT, the USD rose 0.82% against the CAD and closed at 1.2279.

The Canadian Dollar declined against the USD, after one of the Bank of Canada’s (BoC) policymaker suggest “a cautious approach to additional rate hikes”.

The BoC Deputy Governor, Timothy Lane, stated that the central bank, which has raised rates twice in three months, will closely monitor the currency’s impact on the economy and how the economy responds to higher interest rates to decide on future path of monetary policy.

In the Asian session, at GMT0300, the pair is trading at 1.2304, with the USD trading 0.2% higher against the CAD from yesterday’s close.

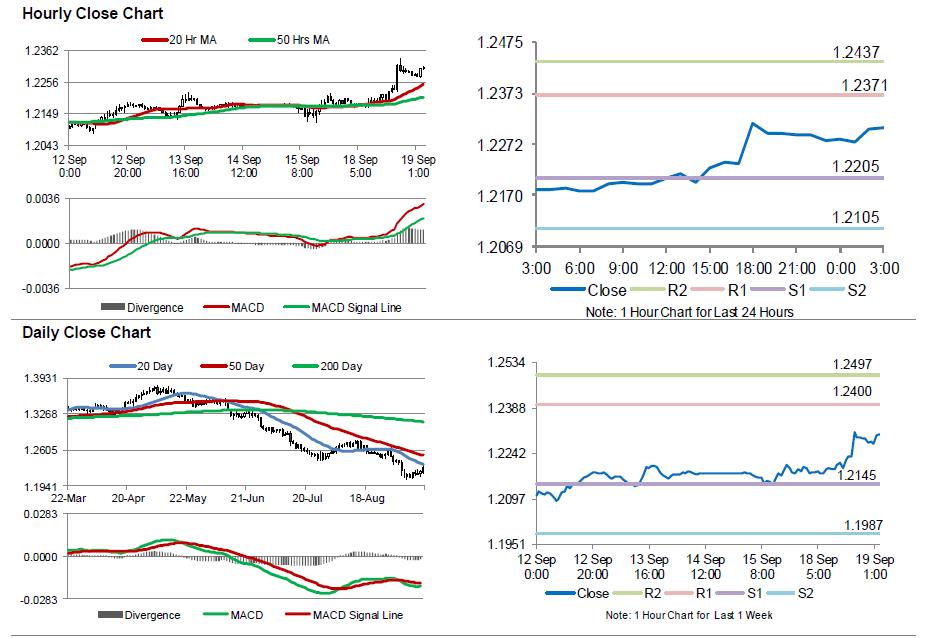

The pair is expected to find support at 1.2205, and a fall through could take it to the next support level of 1.2105. The pair is expected to find its first resistance at 1.2371, and a rise through could take it to the next resistance level of 1.2437.

Amid no major macroeconomic releases in Canada today, investors will look forward to global macroeconomic events for further direction.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.