For the 24 hours to 23:00 GMT, the USD rose 1.08% against the CAD and closed at 1.2620 on Friday.

The Canadian Dollar lost ground against the USD, after Canadian retail sales surprised with an unexpected drop in August and inflation growth missed expectations in September.

Data showed that Canada’s retail sales unexpectedly eased 0.3% on a monthly basis in August, pointing to a slowdown in the nation’s retail sector growth and confounding market consensus for a rise of 0.5%. In the prior month, retail sales had climbed 0.4%.

Meanwhile, the nation’s consumer price index (CPI) rose 1.6% on an annual basis in September, falling short of market expectations for an advance of 1.7%. However, it was the highest reading since April 2017. The CPI had advanced 1.4% in the previous month.

In the Asian session, at GMT0300, the pair is trading at 1.2628, with the USD trading 0.06% higher against the CAD from Friday’s close.

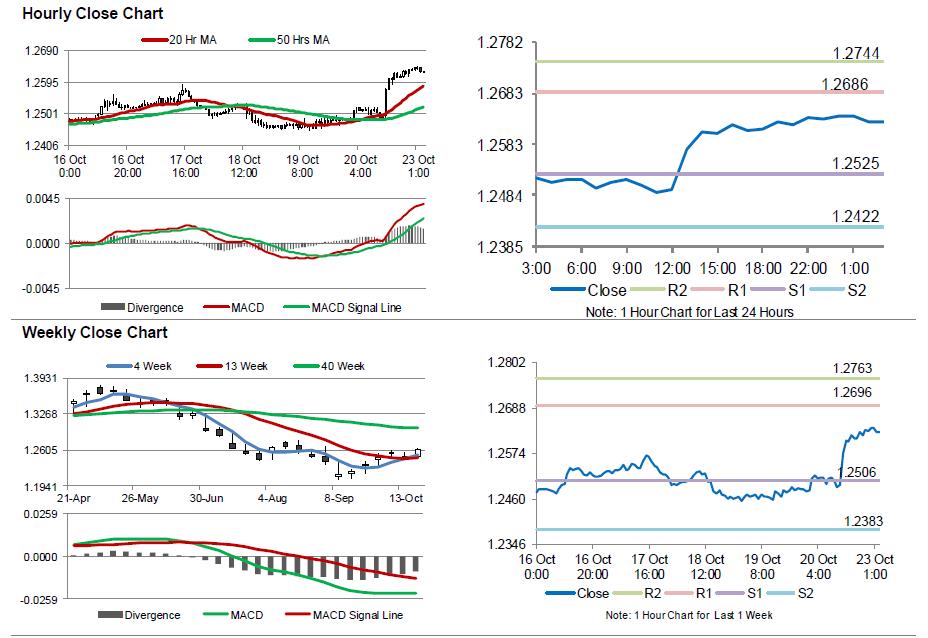

The pair is expected to find support at 1.2525, and a fall through could take it to the next support level of 1.2422. The pair is expected to find its first resistance at 1.2686, and a rise through could take it to the next resistance level of 1.2744.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.