For the 24 hours to 23:00 GMT, the USD rose 0.37% against the CAD and closed at 1.2879 on Friday.

The Canadian Dollar declined against the USD, following disappointing inflation figures in Canada.

Data indicated that Canada’s consumer price index (CPI) rose less-than-anticipated by 2.2% on an annual basis in April, compared to market expectations for a gain of 2.3%. The CPI had climbed 2.3% in the prior month.

On the other hand, the nation’s retail sales climbed more-than-estimated by 0.6% on a monthly basis in March, rising at its quickest pace since October 2017, suggesting that households would propel the nation’s economic growth. Retail sales had registered a revised advance of 0.5% in the previous month, while investors had envisaged for a gain of 0.3%.

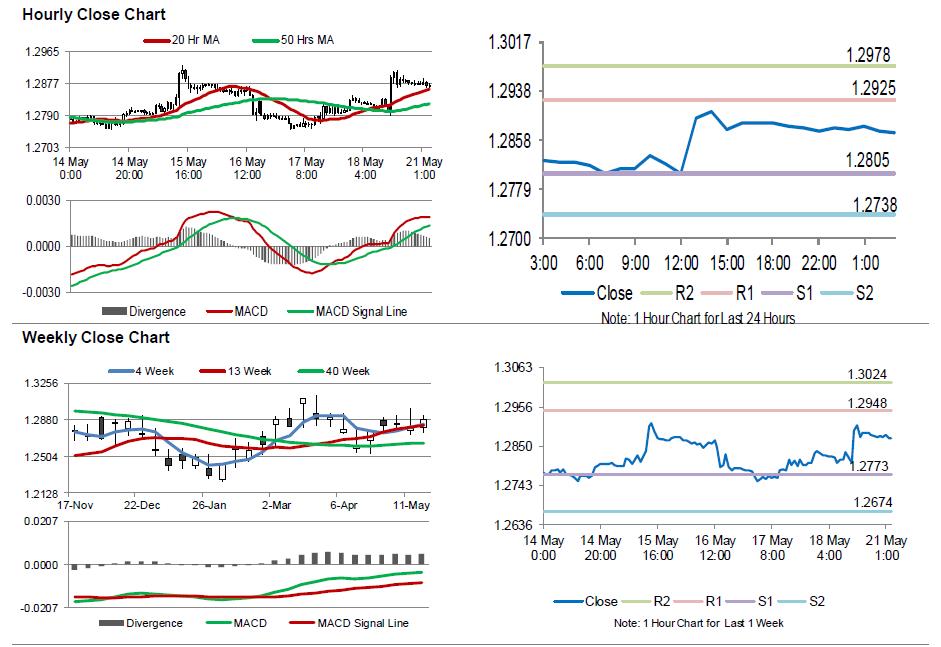

In the Asian session, at GMT0300, the pair is trading at 1.2872, with the USD trading 0.05% lower against the CAD from Friday’s close.

The pair is expected to find support at 1.2805, and a fall through could take it to the next support level of 1.2738. The pair is expected to find its first resistance at 1.2925, and a rise through could take it to the next resistance level of 1.2978.

The currency pair is showing convergence with its 20 Hr moving average and trading above its 50 Hr moving average.