For the 24 hours to 23:00 GMT, the USD rose 1.0% against the CAD and closed at 1.3170 on Friday.

The Canadian Dollar lost ground, after Canada’s annual consumer price index (CPI) rose less-than expected by 1.1% in August, hitting its lowest level in ten months, thus piling pressure on the Bank of Canada to take additional monetary policy measures to boost inflation. The CPI recorded a gain of 1.3% in the preceding month while markets anticipated the CPI to rise by 1.4%. Meanwhile, on a monthly basis, the CPI unexpectedly dropped by 0.2% in August, compared to a similar fall recorded in the previous month while markets expected the CPI to gain by 0.1%. Moreover, the nation’s retail sales surprisingly eased by 0.1% MoM in July, defying investor consensus for an advance of 0.1%. Retail sales had registered a revised flat reading in the previous month.

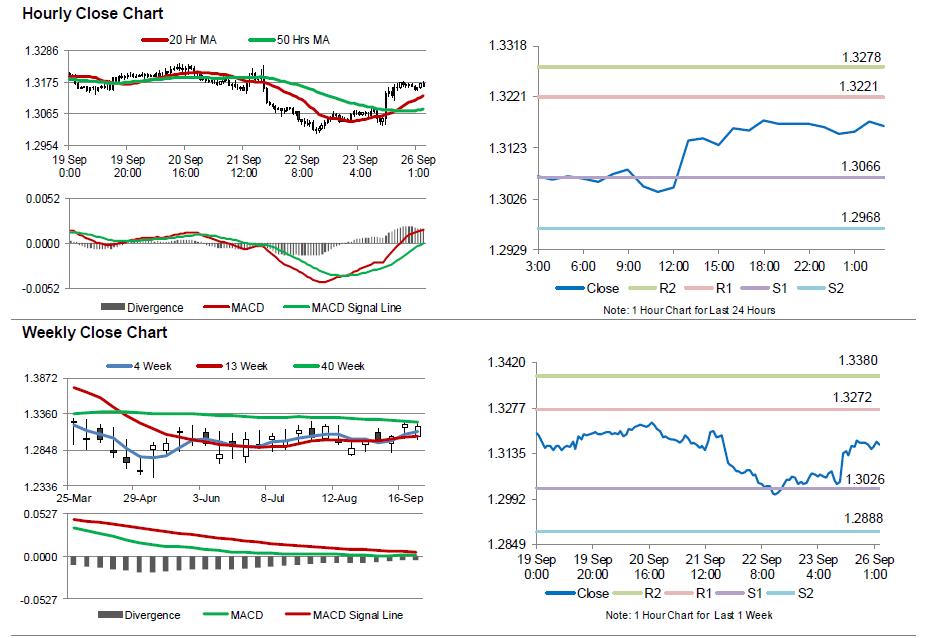

In the Asian session, at GMT0300, the pair is trading at 1.3164, with the USD trading a tad lower against the CAD from Friday’s close.

The pair is expected to find support at 1.3066, and a fall through could take it to the next support level of 1.2968. The pair is expected to find its first resistance at 1.3221, and a rise through could take it to the next resistance level of 1.3278.

Amid a lack of economic releases in Canada today, trading trend in the CAD is expected to be determined by global macroeconomic events

The currency pair is trading above its 20 Hr and 50 Hr moving averages.