For the 24 hours to 23:00 GMT, the USD rose 0.5% against the CAD and closed at 1.3145.

Macroeconomic data indicated that Canada’s annual consumer price index remained steady at 1.5% YoY in June, aided by rising home and car expenses and beating market expectations of a rise by 1.4%. Meanwhile, on a monthly basis, the consumer price index rose more-than-anticipated by 0.2% in June, compared to market expectations of an advance of 0.1% and following a rise of 0.4% in the previous month. Additionally, the nation’s retail sales unexpectedly rose by 0.2% MoM in May, thus providing some sign of relief to the economy struggling with lower commodity prices. Retail sales in Canada had climbed by a revised 0.8% in the previous month whereas markets expected it to remain flat.

In the Asian session, at GMT0300, the pair is trading at 1.3135, with the USD trading 0.08% lower against the CAD from Friday’s close.

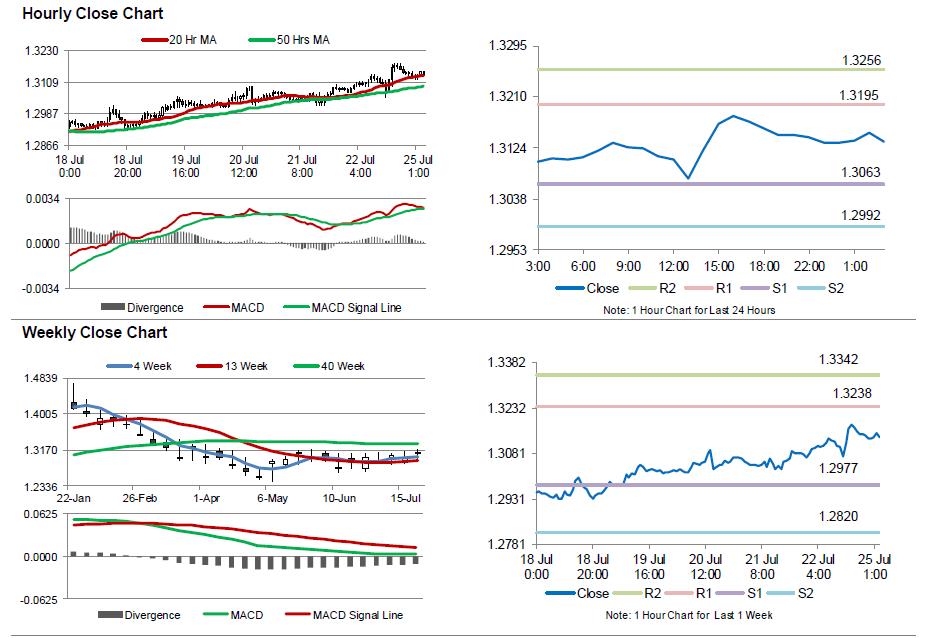

The pair is expected to find support at 1.3063, and a fall through could take it to the next support level of 1.2992. The pair is expected to find its first resistance at 1.3195, and a rise through could take it to the next resistance level of 1.3256.

Investors now would keenly await for Canadian GDP figures for May, being the only important data release this week, which would be on Friday.

The currency pair is showing convergence with its 20 Hr moving average and trading above its 50 Hr moving average.