For the 24 hours to 23:00 GMT, the USD rose 0.28% against the CAD and closed at 1.3503 on Friday.

The Canadian Dollar lost ground, after the consumer price index (CPI) in Canada advanced less-than-anticipated by 1.6% YoY in March, affirming the central bank’s view that a recent rise in inflation was temporary. In the previous month, the CPI had advanced 2.0%, whereas markets expected for a gain of 1.8%. Meanwhile, on a monthly basis, the CPI rose less-than-estimated by 0.2% in March, compared to a similar rise in the prior month. Market expectation was for the CPI to advance 0.4%.

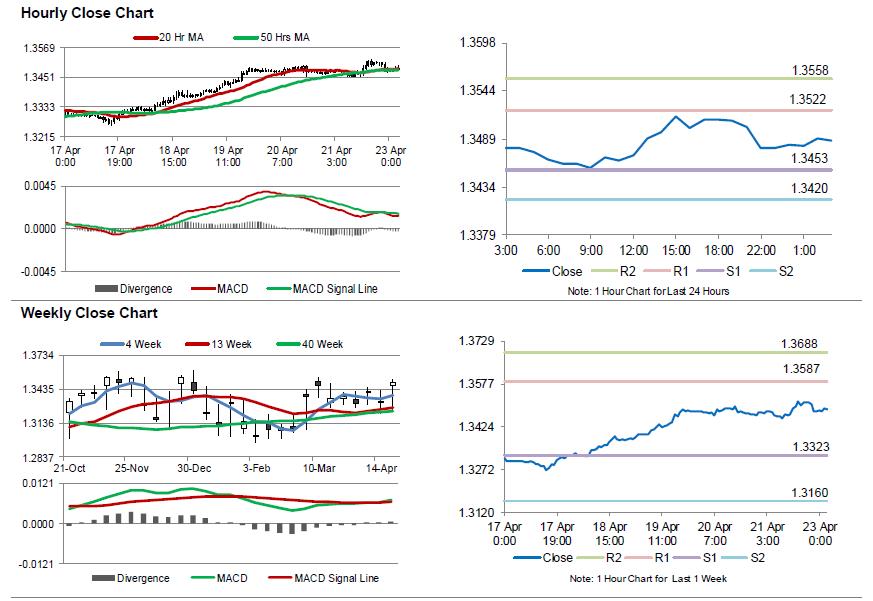

In the Asian session, at GMT0300, the pair is trading at 1.3487, with the USD trading 0.12% lower against the CAD from Friday’s close.

The pair is expected to find support at 1.3453, and a fall through could take it to the next support level of 1.342. The pair is expected to find its first resistance at 1.3522, and a rise through could take it to the next resistance level of 1.3558.

The currency pair is showing convergence with its 20 Hr and 50 Hr moving averages.