For the 24 hours to 23:00 GMT, the USD rose 0.08% against the CAD and closed at 1.3292 on Friday.

On the macro front, data revealed that Canada’s annualised gross domestic product (GDP) advanced 2.0% on a quarterly basis in 3Q 2018, meeting market expectations. In the prior quarter, the GDP had recoded a gain of 2.9%.

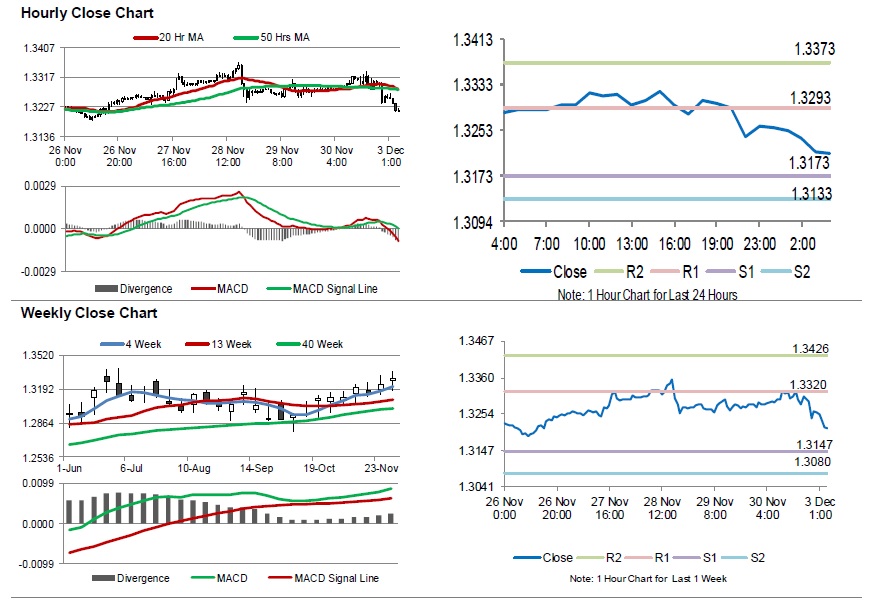

In the Asian session, at GMT0400, the pair is trading at 1.3213, with the USD trading 0.59% lower against the CAD from Friday’s close.

The pair is expected to find support at 1.3173, and a fall through could take it to the next support level of 1.3133. The pair is expected to find its first resistance at 1.3293, and a rise through could take it to the next resistance level of 1.3373.

Moving ahead, traders would await Canada’s RBC manufacturing PMI for November and MLI leading indicator for October, set to release later in the day.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.