For the 24 hours to 23:00 GMT, the USD rose 0.4% against the CAD and closed at 1.3785.

On the economic front, Canada’s consumer price index unexpectedly rose by 0.2% MoM in January, whereas investors expected it to remain flat, after recording a drop of 0.5% in the previous month. Meanwhile, the annual inflation rose to its highest level since November 2014, after it advanced by 2.0% in January. On the other hand, the nation’s retail sales declined 2.2% MoM in December, more than market expectations for a fall of 0.9% and following a gain of 1.7% in the previous month.

In the Asian session, at GMT0400, the pair is trading at 1.3757, with the USD trading 0.21% lower from Friday’s close.

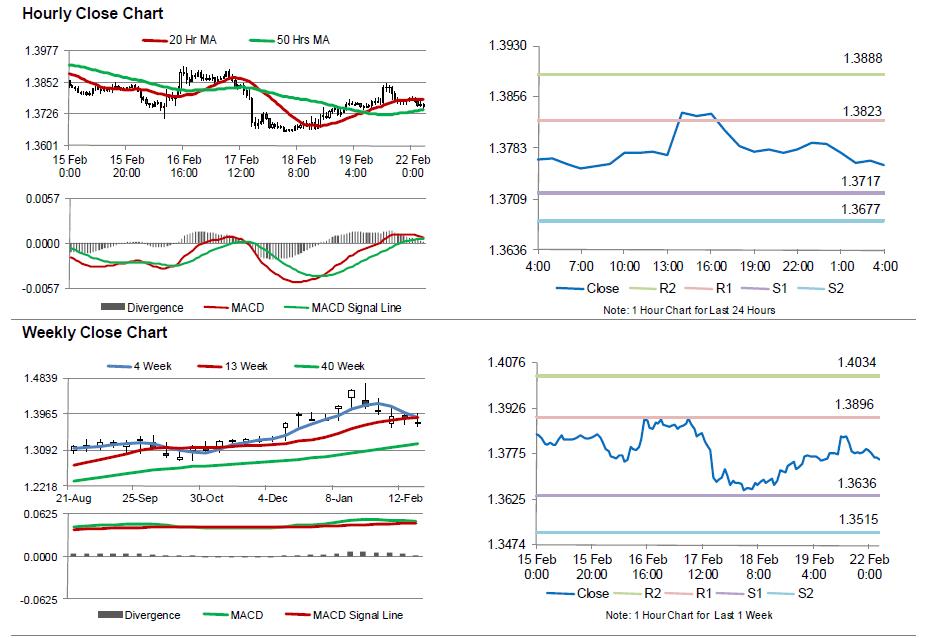

The pair is expected to find support at 1.3717, and a fall through could take it to the next support level of 1.3677. The pair is expected to find its first resistance at 1.3823, and a rise through could take it to the next resistance level of 1.3888.

Amid no economic releases in Canada today, investor sentiment would be governed by global macroeconomic news.

The currency pair is trading between its 20 Hr and 50 Hr moving averages.