For the 24 hours to 23:00 GMT, the USD rose 2.40% against the CAD and closed at 1.3301 on Friday.

On the macro front, Canada’s unemployment rate declined to 5.5% in January, defying market forecast for an unchanged reading. In the previous month, unemployment rate stood at 5.6%. Moreover, Ivey Purchasing Managers’ Index advanced to 57.3 in January, driven by a rise in supplier deliveries and compared to a level of 51.9 in the previous month.

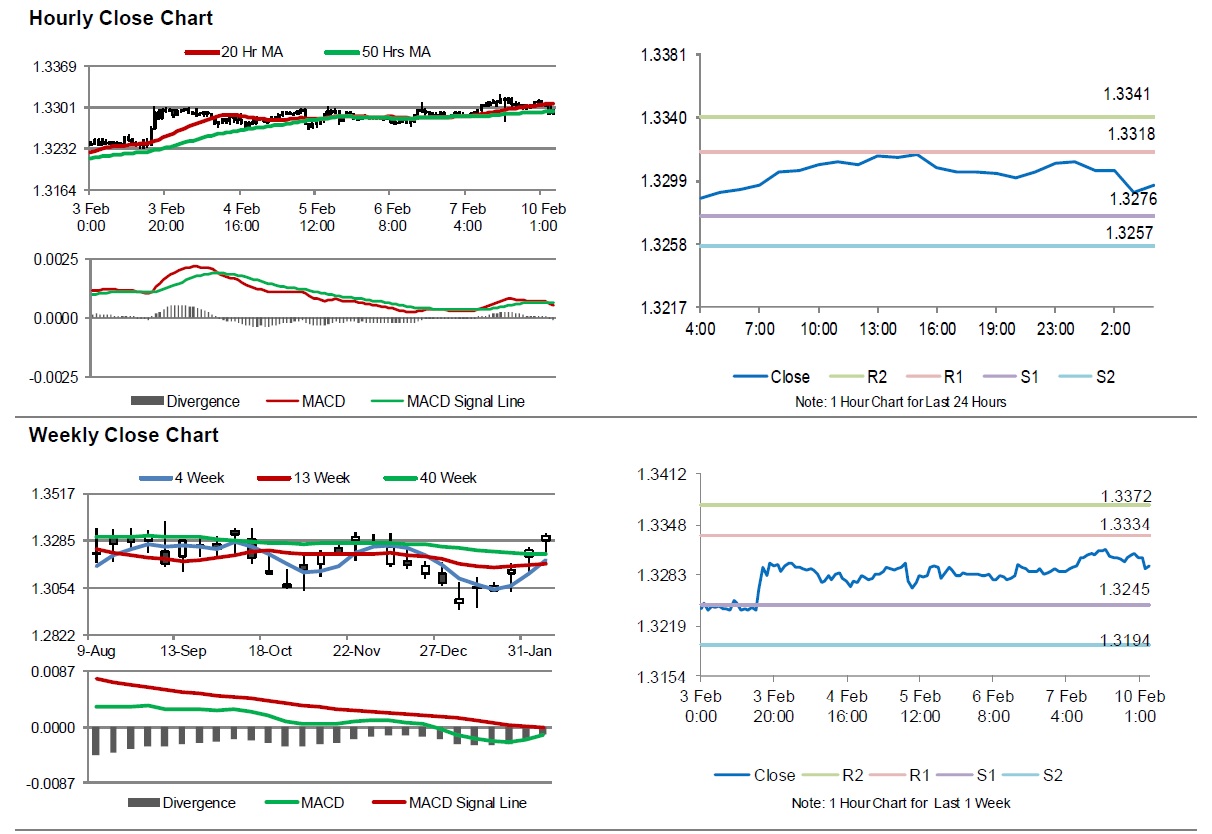

In the Asian session, at GMT0400, the pair is trading at 1.3296, with the USD trading marginally lower against the CAD from Friday’s close.

The pair is expected to find support at 1.3276, and a fall through could take it to the next support level of 1.3257. The pair is expected to find its first resistance at 1.3318, and a rise through could take it to the next resistance level of 1.3341.

Going ahead, traders would focus on Canada’s housing starts for January and building permits for December, slated to release later today.

The currency pair is trading below its 20 Hr moving average and showing convergence with its 50 Hr moving average.