For the 24 hours to 23:00 GMT, the USD rose 0.43% against the CAD and closed at 1.2945.

The Canadian Dollar declined against the US Dollar, following news that US will impose tariffs on steel and aluminium imported from Canada.

Losses in Canadian Dollar were extended, after Canada’s annualised gross domestic product (GDP) rose 1.3% on a quarterly basis in the first quarter of 2018, expanding at its weakest pace in 2 years. In the previous quarter, GDP had recorded an advance of 1.7%, while markets were expecting for a rise of 1.8%.

In the Asian session, at GMT0300, the pair is trading at 1.2953, with the USD trading 0.06% higher against the CAD from yesterday’s close.

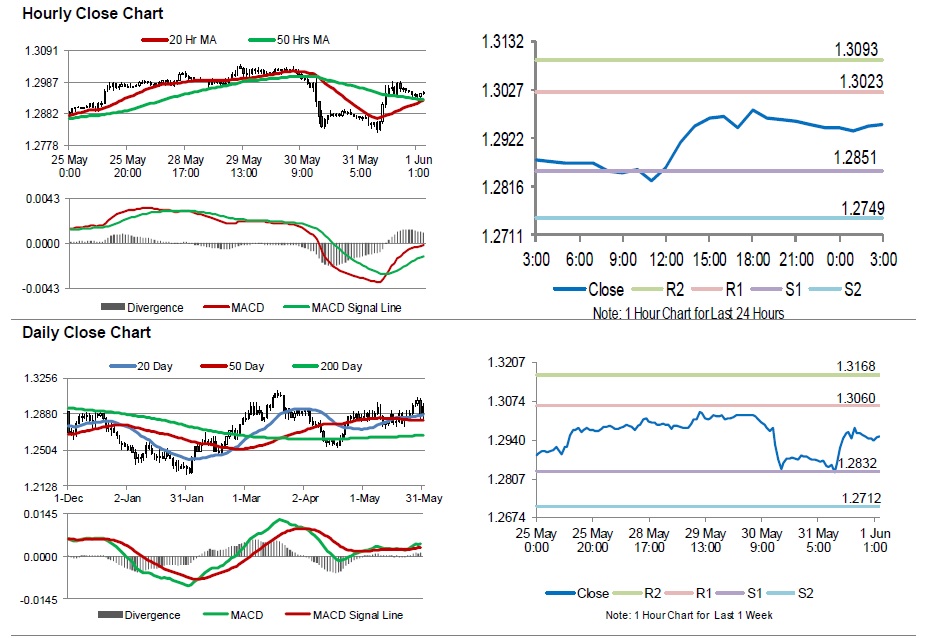

The pair is expected to find support at 1.2851, and a fall through could take it to the next support level of 1.2749. The pair is expected to find its first resistance at 1.3023, and a rise through could take it to the next resistance level of 1.3093.

Going forward, investor sentiment will be determined by the release of Canada’s manufacturing PMI, scheduled to release later in the day.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.