On Friday, the USD rose 0.55% against the CAD to close at 1.2689. The Canadian Dollar came under pressure, after Canada’s GDP unexpectedly contracted 0.2% on a monthly basis in November, posting its biggest drop in 11 months and compared to a 0.3% growth recorded in previous month, thus increasing speculations that the BoC would make another rate cut following previous week’s surprise move by the central bank.

In the Asian session, at GMT0400, the pair is trading at 1.2737, with the USD trading 0.38% higher from Friday’s close.

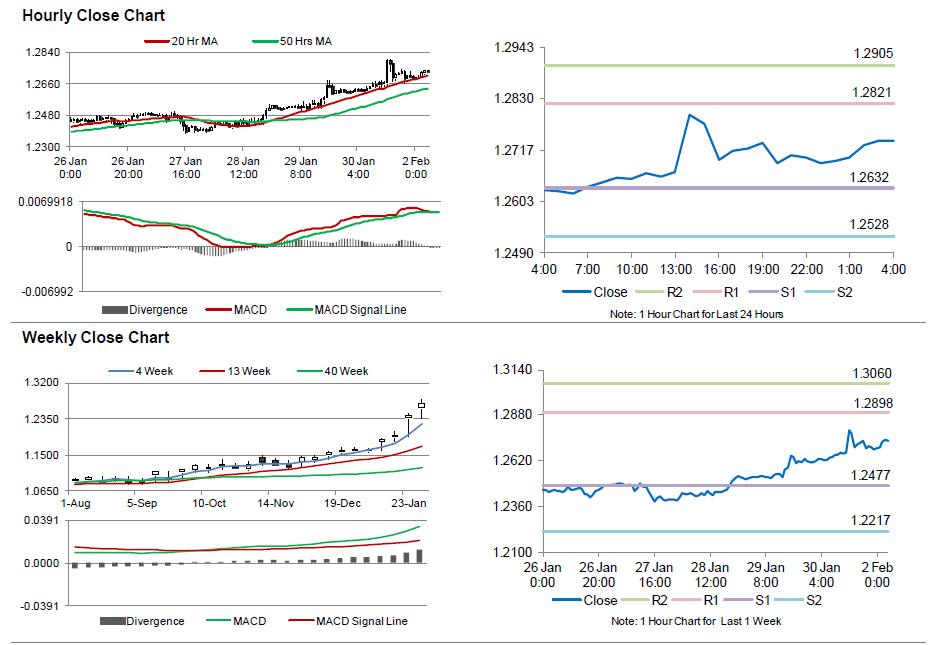

The pair is expected to find support at 1.2632, and a fall through could take it to the next support level of 1.2528. The pair is expected to find its first resistance at 1.2821, and a rise through could take it to the next resistance level of 1.2905.

Looking ahead, market participants would closely monitor Canada’s RBC manufacturing PMI data, scheduled later today.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.