For the 24 hours to 23:00 GMT, the USD rose 0.15% against the CAD and closed at 1.3350 on Friday.

Macroeconomic data showed that Canada’s manufacturing shipments rebounded 1.0% in January, higher than market anticipations for a rise of 0.4%. Manufacturing shipments had recorded a revised decline of 1.1% in the prior month. Meanwhile, the nation’s existing home sales plunged 9.1% on a monthly basis in February, surpassing market expectations for a fall of 4.0%. In the prior month, existing home sales had recorded a rise of 3.6%.

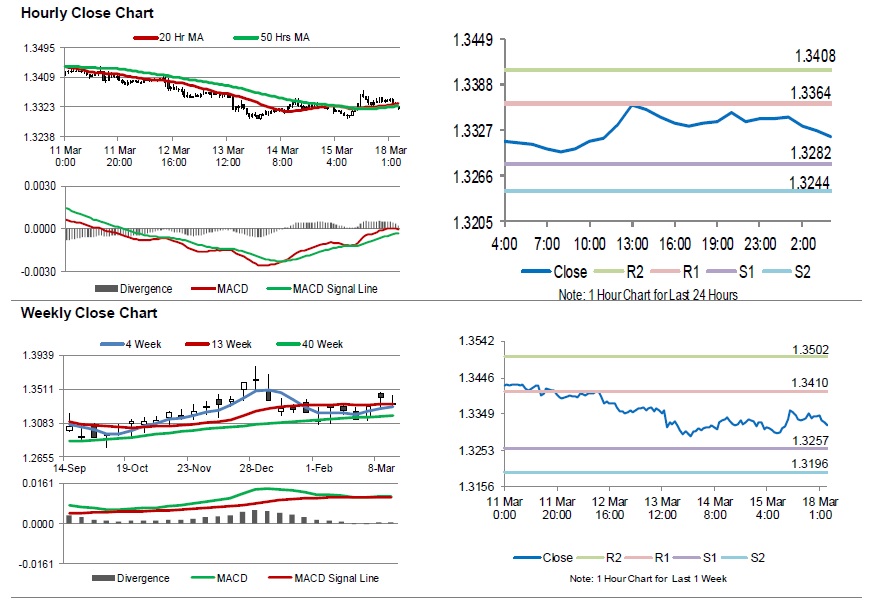

In the Asian session, at GMT0400, the pair is trading at 1.3319, with the USD trading 0.23% lower against the CAD from Friday’s close.

The pair is expected to find support at 1.3282, and a fall through could take it to the next support level of 1.3244. The pair is expected to find its first resistance at 1.3364, and a rise through could take it to the next resistance level of 1.3408.

Amid lack of economic releases in Canada today, traders would focus on global macroeconomic events for further direction.

The currency pair is trading below its 20 Hr moving average and showing convergence with its 50 Hr moving average.