For the 24 hours to 23:00 GMT, the USD rose 0.55% against the CAD and closed at 1.2874.

The Canadian Dollar declined against the USD, after Canada’s existing home sales unexpectedly dropped 2.9% on a monthly basis in April, dipping to a 5-year low level and defying market consensus for a gain of 0.4%. Existing home sales posted a rise of 1.3% in the prior month.

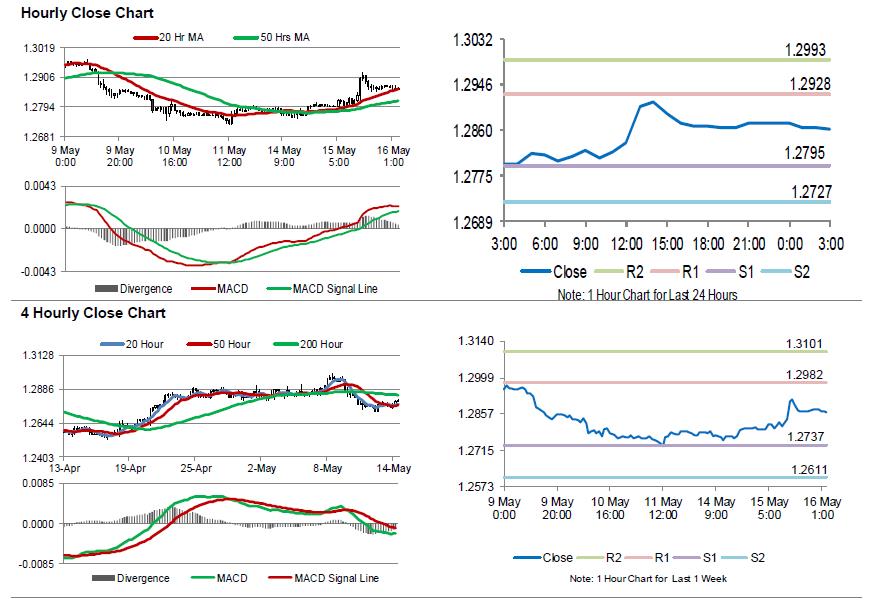

In the Asian session, at GMT0300, the pair is trading at 1.2863, with the USD trading 0.09% lower against the CAD from yesterday’s close.

The pair is expected to find support at 1.2795, and a fall through could take it to the next support level of 1.2727. The pair is expected to find its first resistance at 1.2928, and a rise through could take it to the next resistance level of 1.2993.

Later in the day, traders would look forward to Canada’s manufacturing shipments for March.

The currency pair is showing convergence with its 20 Hr moving average and trading above its 50 Hr moving average.