For the 24 hours to 23:00 GMT, the USD rose 0.30% against the CAD and closed at 1.3156.

On the macro front, Canada’s gross domestic product (GDP) unexpectedly expanded by 0.1% on a monthly basis in August, for the seventh consecutive month and defying market expectations for a flat reading. In the previous month, the GDP had registered a rise of 0.2%.

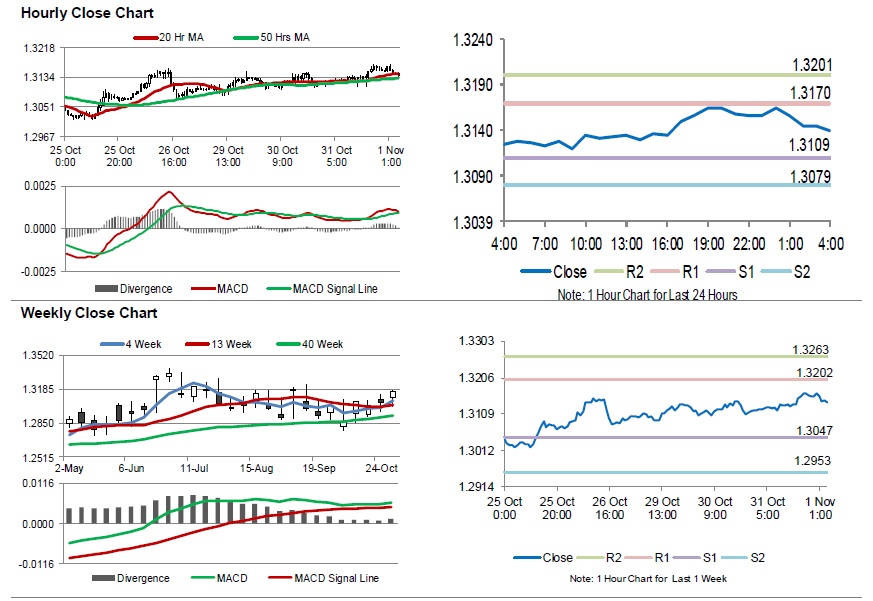

In the Asian session, at GMT0400, the pair is trading at 1.3140, with the USD trading 0.12% lower against the CAD from yesterday’s close.

The pair is expected to find support at 1.3109, and a fall through could take it to the next support level of 1.3079. The pair is expected to find its first resistance at 1.3170, and a rise through could take it to the next resistance level of 1.3201.

Looking ahead, traders would await Canada’s leading indicator for September and the RBC manufacturing PMI for October, scheduled to release later in the day.

The currency pair is showing convergence with its 20 Hr moving average and trading above its 50 Hr moving average.