For the 24 hours to 23:00 GMT, the USD rose 0.21% against the CAD and closed at 1.3127.

On the data front, Canada’s seasonally adjusted housing starts rose to a level of 245.7K in June, hitting it highest level since 2007 and following market expectations for an advance to a level of 208.6K. In the previous month, housing starts had registered a revised level of 196.8K. Meanwhile, the nation’s building permits plunged 13.0% on a monthly basis in May, more than market expectations for a fall of 10.0%. Building permits had recorded a revised gain of 16.0% in the prior month.

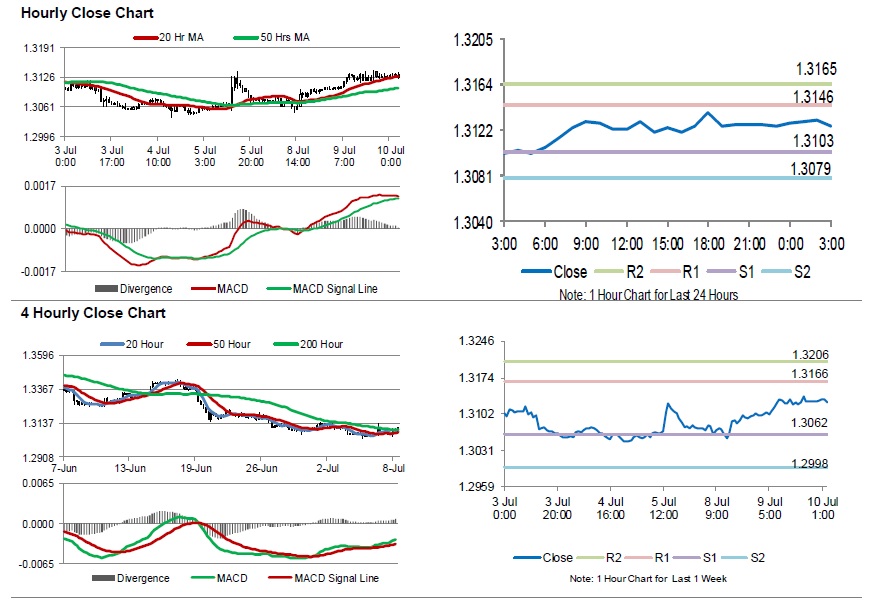

In the Asian session, at GMT0300, the pair is trading at 1.3126, with the USD trading marginally lower against the CAD from yesterday’s close.

The pair is expected to find support at 1.3103, and a fall through could take it to the next support level of 1.3079. The pair is expected to find its first resistance at 1.3146, and a rise through could take it to the next resistance level of 1.3165.

Looking ahead, investors would closely monitor the Bank of Canada’s interest rate decision, slated to release later in the day.

The currency pair is showing convergence with its 20 Hr moving average and trading above its 50 Hr moving average.