For the 24 hours to 23:00 GMT, the USD rose 0.24% against the CAD and closed at 1.2698.

Macroeconomic data indicated that Canada’s seasonally adjusted housing starts surprisingly advanced to a level of 222.3K in July, defying market expectations for a fall to a level of 205.0K and highlighting resilience in the nation’s housing market. In the prior month, housing starts had recorded a revised level of 212.9K. Moreover, the nation’s building permits unexpectedly climbed 2.5% on a monthly basis in June, amid increased plans for commercial buildings. Building permits registered a revised rise of 10.7% in the previous month, while markets had envisaged for a drop of 1.9%.

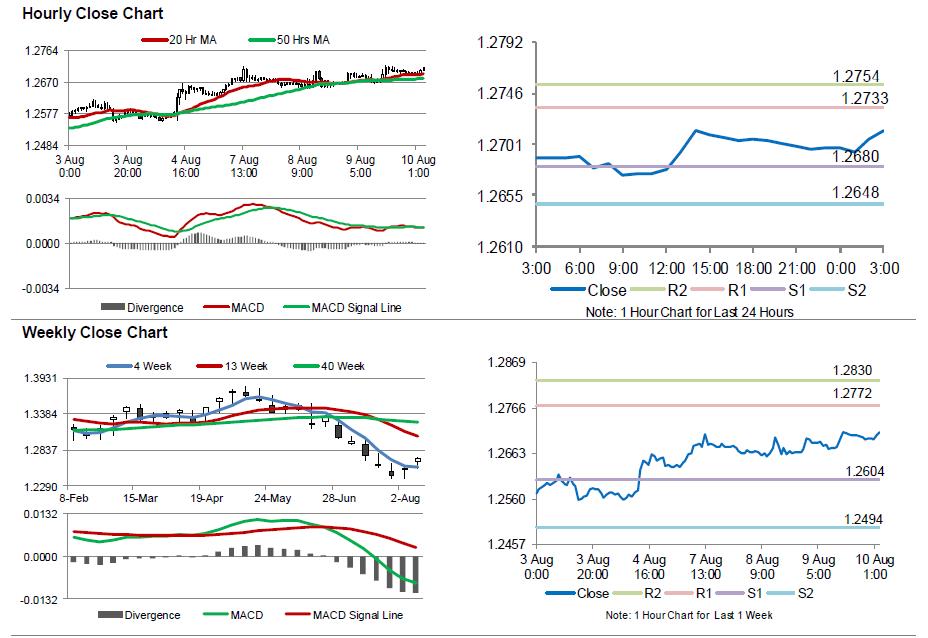

In the Asian session, at GMT0300, the pair is trading at 1.2713, with the USD trading 0.12% higher against the CAD from yesterday’s close.

The pair is expected to find support at 1.2680, and a fall through could take it to the next support level of 1.2648. The pair is expected to find its first resistance at 1.2733, and a rise through could take it to the next resistance level of 1.2754.

Ahead in the day, the release of Canada’s new house price index for June, will be on investors’ radar.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.