For the 24 hours to 23:00 GMT, the USD rose 0.63% against the CAD and closed at 1.2855.

The Canadian Dollar lost ground, after disappointing economic data reignited speculation that growth has contracted in the second quarter.

Data indicated that Canada’s consumer price index (CPI) unexpectedly dropped by 0.2% on monthly basis in July. The CPI was expected to a show a flat reading, following a gain of 0.2% in the previous month. Meanwhile, on an annual basis, the index rose less-than-expected by 1.3% in July, amid lower costs for gasoline and clothing, compared to market expectations for a rise of 1.4% and after recording a gain of 1.5% in the prior month. Additionally, the nation’s retail sales unexpectedly fell by 0.1% on a monthly basis in June, compared to a revised flat reading in the prior month and defying market expectations for an advance of 0.5%.

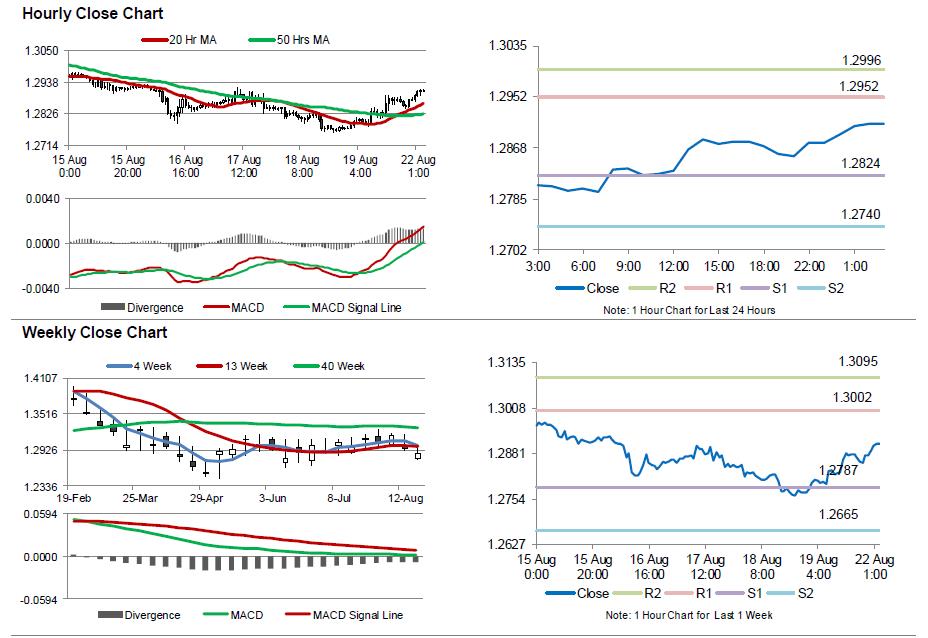

In the Asian session, at GMT0300, the pair is trading at 1.2908, with the USD trading 0.41% higher against the CAD from Friday’s close.

The pair is expected to find support at 1.2824, and a fall through could take it to the next support level of 1.274. The pair is expected to find its first resistance at 1.2952, and a rise through could take it to the next resistance level of 1.2996.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.