For the 24 hours to 23:00 GMT, the USD declined 0.33% against the CAD and closed at 1.2498.

In economic news, Canada’s seasonally adjusted Ivey–PMI fell to a level of 55.2 in January, compared to a reading of 60.4 in the prior month. Furthermore, the nation’s international merchandise trade deficit surprisingly widened to C$3.19 billion in December, amid a surge in imports and confounding market expectations for the deficit to narrow to C$2.32 billion. The nation had registered a revised trade deficit of C$2.71 billion in the previous month.

In the Asian session, at GMT0400, the pair is trading at 1.2513, with the USD trading 0.12% higher against the CAD from yesterday’s close.

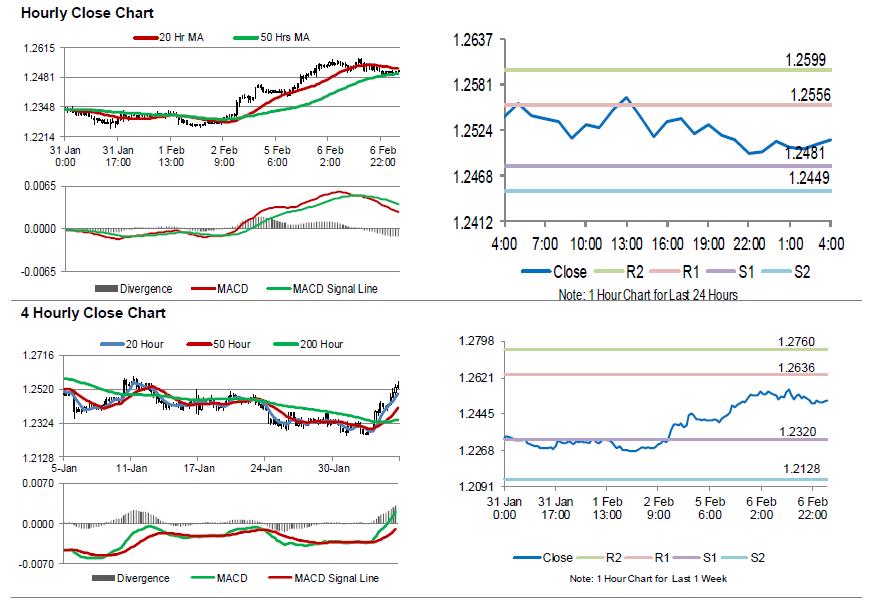

The pair is expected to find support at 1.2481, and a fall through could take it to the next support level of 1.2449. The pair is expected to find its first resistance at 1.2556, and a rise through could take it to the next resistance level of 1.2599.

Ahead in the day, traders would keep a close watch on Canada’s building permits data for December.

The currency pair is showing convergence with its 20 Hr moving average and trading above its 50 Hr moving average.