For the 24 hours to 23:00 GMT, the USD rose 0.08% against the CAD and closed at 1.3276.

In economic news, Canada’s seasonally adjusted Ivey purchasing mangers’ index unexpectedly eased to a level of 56.8 in November, confounding market expectations for an advance to a level of 60.0 and after recording a level of 59.7 in the previous month. Moreover, the nation’s international merchandise trade deficit fell to a level of C$1.1 billion in October, contracting to its lowest level in nearly a year, from a revised international merchandise trade deficit of C$4.4 billion in the previous month.

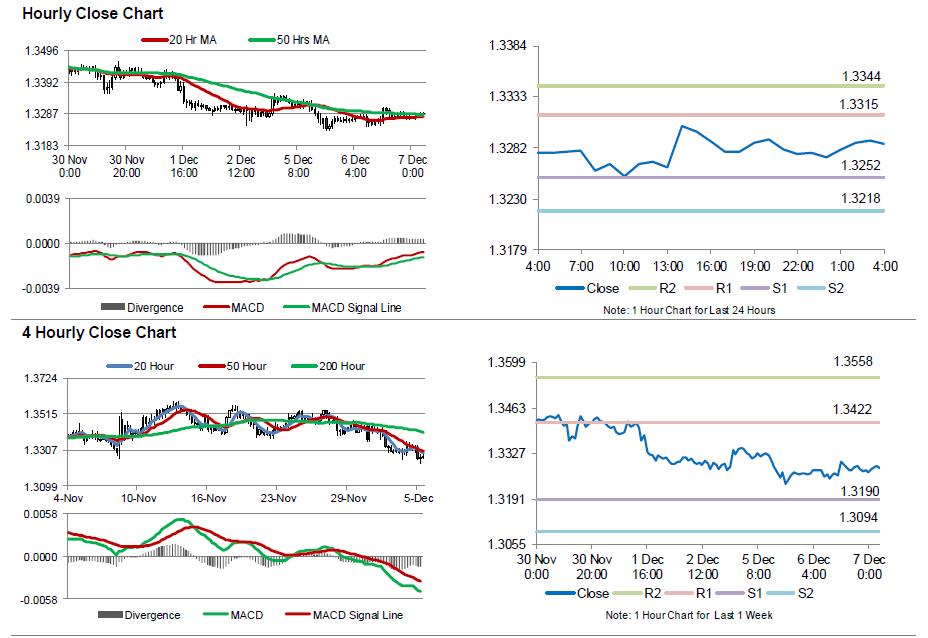

In the Asian session, at GMT0400, the pair is trading at 1.3285, with the USD trading 0.07% higher against the CAD from yesterday’s close.

The pair is expected to find support at 1.3252, and a fall through could take it to the next support level of 1.3218. The pair is expected to find its first resistance at 1.3315, and a rise through could take it to the next resistance level of 1.3344.

Moving ahead, market participants would keep a close eye on Bank of Canada’s interest rate decision, due later in the day.

The currency pair is showing convergence with its 20 Hr and 50 Hr moving averages.