For the 24 hours to 23:00 GMT, the USD declined 0.18% against the CAD and closed at 1.2874.

Data showed that Canada’s manufacturing PMI eased to a level of 54.3 in October as supply chains at firms were disrupted by Hurricane Harvey in the US and as new export orders slumped last month. In the previous month, the index had recorded a reading of 55.0.

Meanwhile, the Bank of Canada (BoC) Governor, Stephen Poloz, indicated in his testimony that while monetary policy decisions would have an effect on the nation’s currency, crude oil prices would also have a huge long-term impact on the Canadian Dollar.

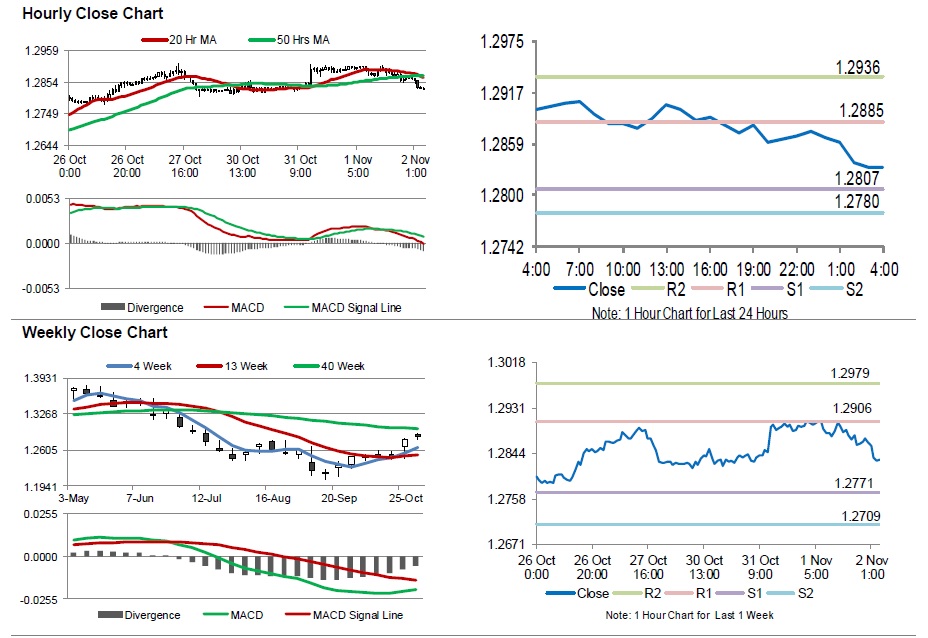

In the Asian session, at GMT0400, the pair is trading at 1.2833, with the USD trading 0.32% lower from yesterday’s close.

The pair is expected to find support at 1.2807, and a fall through could take it to the next support level of 1.278. The pair is expected to find its first resistance at 1.2885, and a rise through could take it to the next resistance level of 1.2936.

Amid a lack of any major economic releases in Canada today, investors will focus on global macro events for further direction.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.