For the 24 hours to 23:00 GMT, the USD declined 0.11% against the CAD and closed at 1.2754.

Macroeconomic data revealed that Canada’s manufacturing shipments unexpectedly advanced 0.5% on a monthly basis in September, defying market expectations for a fall of 0.5%. In the previous month, manufacturing shipments had recorded a revised rise of 1.4%.

In the Asian session, at GMT0400, the pair is trading at 1.2726, with the USD trading 0.22% lower against the CAD from yesterday’s close.

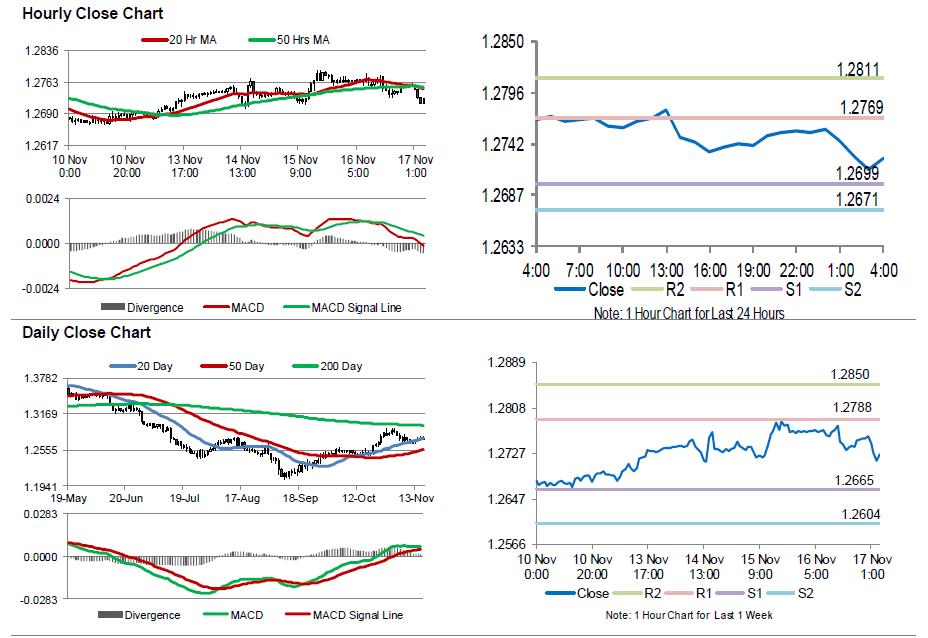

The pair is expected to find support at 1.2699, and a fall through could take it to the next support level of 1.2671. The pair is expected to find its first resistance at 1.2769, and a rise through could take it to the next resistance level of 1.2811.

This afternoon will bring a crucial Canadian release, namely the consumer price inflation data for October.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.