On Friday, the USD declined 0.29% against the CAD to close at 1.1209.

The Canadian Dollar advanced against its US counterpart as the latest batch of upbeat economic data from the Canadian economy dampened speculations for an interest rate cut by the Bank of Canada.

Data showed that consumer inflation rate in Canada rose to 0.8% (MoM) in February, more than analysts’ call for a rise to 0.6%, from previous month’s level of 0.3%. Another report showed that Canada’s retail sales rose more-than-expected 1.3% (MoM) in January, the fastest pace in eight months, compared to a 1.9% drop in the preceding month.

In the Asian session, at GMT0400, the pair is trading at 1.1233, with the USD trading 0.21% higher from Friday’s close.

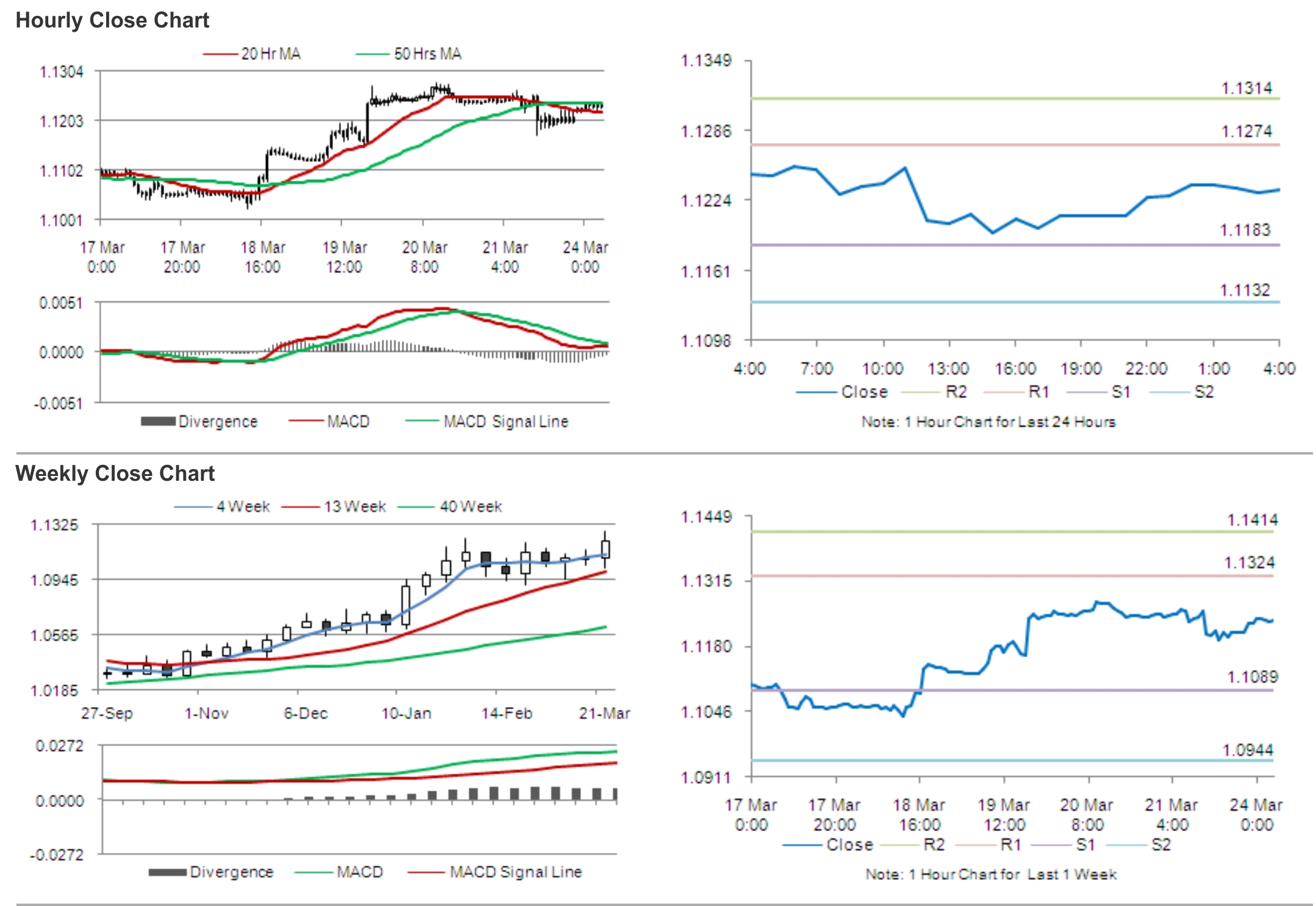

The pair is expected to find support at 1.1183, and a fall through could take it to the next support level of 1.1132. The pair is expected to find its first resistance at 1.1274, and a rise through could take it to the next resistance level of 1.1314.

Traders would eye global economic news, along with the US Markit manufacturing and the Chiacgo Fed national activity index data, for further cues in the currency pair, amid lack of economic data from Canada.

The currency pair is trading just above its 20 Hr moving average and is showing convergence with its 50 Hr moving average.