For the 24 hours to 23:00 GMT, the USD rose 0.17% against the CAD to close at 1.3096.

The CAD weakened, after the nation’s manufacturing activity slid for the third consecutive month.

Data showed that Canada’s RBC manufacturing PMI declined to a level of 48.0 in October, from a reading of 48.6 in the previous month, led by a fall in the country’s output, employment and new orders.

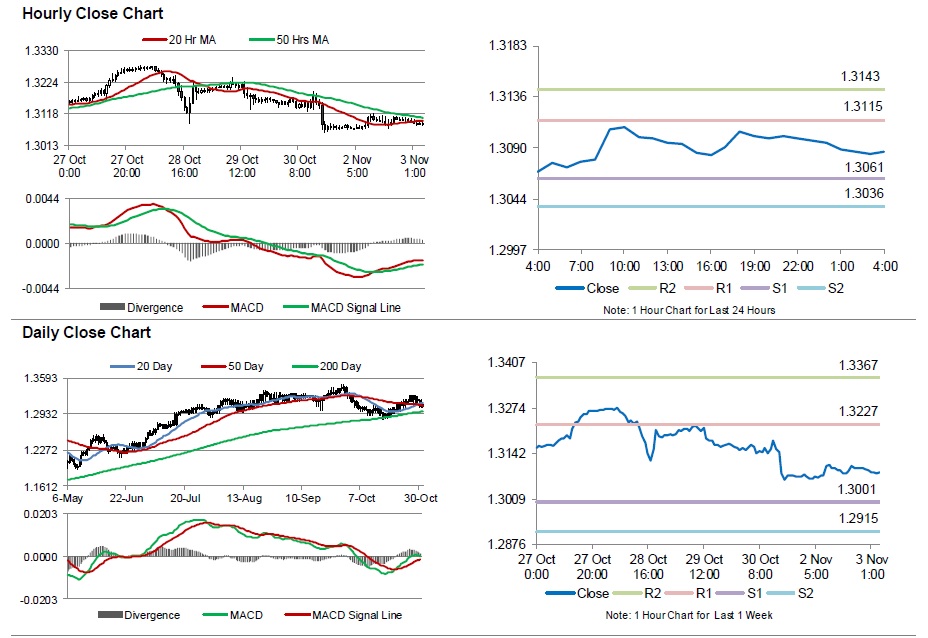

In the Asian session, at GMT0400, the pair is trading at 1.3087, with the USD trading marginally lower from yesterday’s close.

The pair is expected to find support at 1.3061, and a fall through could take it to the next support level of 1.3036. The pair is expected to find its first resistance at 1.3115, and a rise through could take it to the next resistance level of 1.3143.

Moving ahead, market participants will closely watch Canada’s unemployment rate data for October, scheduled to be released later this week.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.