For the 24 hours to 23:00 GMT, the USD rose 0.09% against the CAD and closed at 1.2713.

The Canadian Dollar declined against the USD, on the back of disappointing Canadian retail sales data.

Macroeconomic data revealed that retail sales in Canada rebounded 0.1% on a monthly basis in September, falling short of market expectations for a rise of 1.0%, suggesting that consumers are paring back spending in the second half of this year. Retail sales had registered a revised drop of 0.1% in the prior month.

In the Asian session, at GMT0400, the pair is trading at 1.2729, with the USD trading 0.13% higher against the CAD from yesterday’s close.

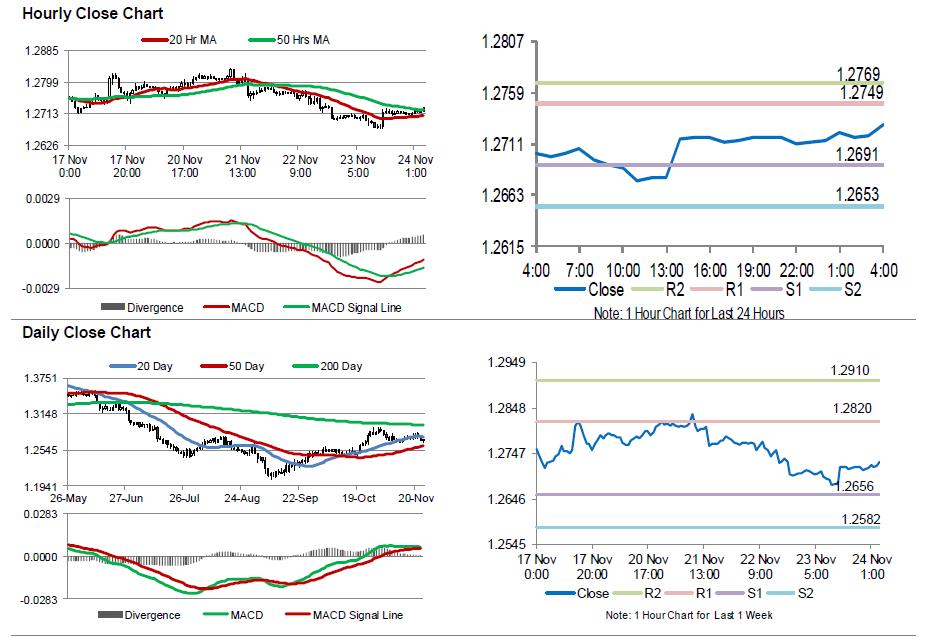

The pair is expected to find support at 1.2691, and a fall through could take it to the next support level of 1.2653. The pair is expected to find its first resistance at 1.2749, and a rise through could take it to the next resistance level of 1.2769.

Moving ahead, a speech by the Bank of Canada’s (BoC) Governor, Stephen Poloz, due next week, will keep investors on their toes.

The currency pair is trading above its 20 Hr moving average and showing convergence with its 50 Hr moving average.