For the 24 hours to 23:00 GMT, the USD rose 0.25% against the CAD and closed at 1.3159 on Friday.

The Canadian dollar declined against the US dollar, amid fears that disappointing economic data releases could force the Bank of Canada to consider a rate cut.

In economic news, Canada’s retail sales unexpectedly fell 1.2% on a monthly basis in October, declining for the first time in four months and driven by a decline in sales of motor vehicle and parts and building material. In the previous month, retail sales recorded a revised flat reading. Additionally, new housing price index fell 0.1% on a monthly basis in October, compared to a revised increase of 0.1% in the prior month.

In the Asian session, at GMT0400, the pair is trading at 1.3157, with the USD trading slightly lower against the CAD from Friday’s close.

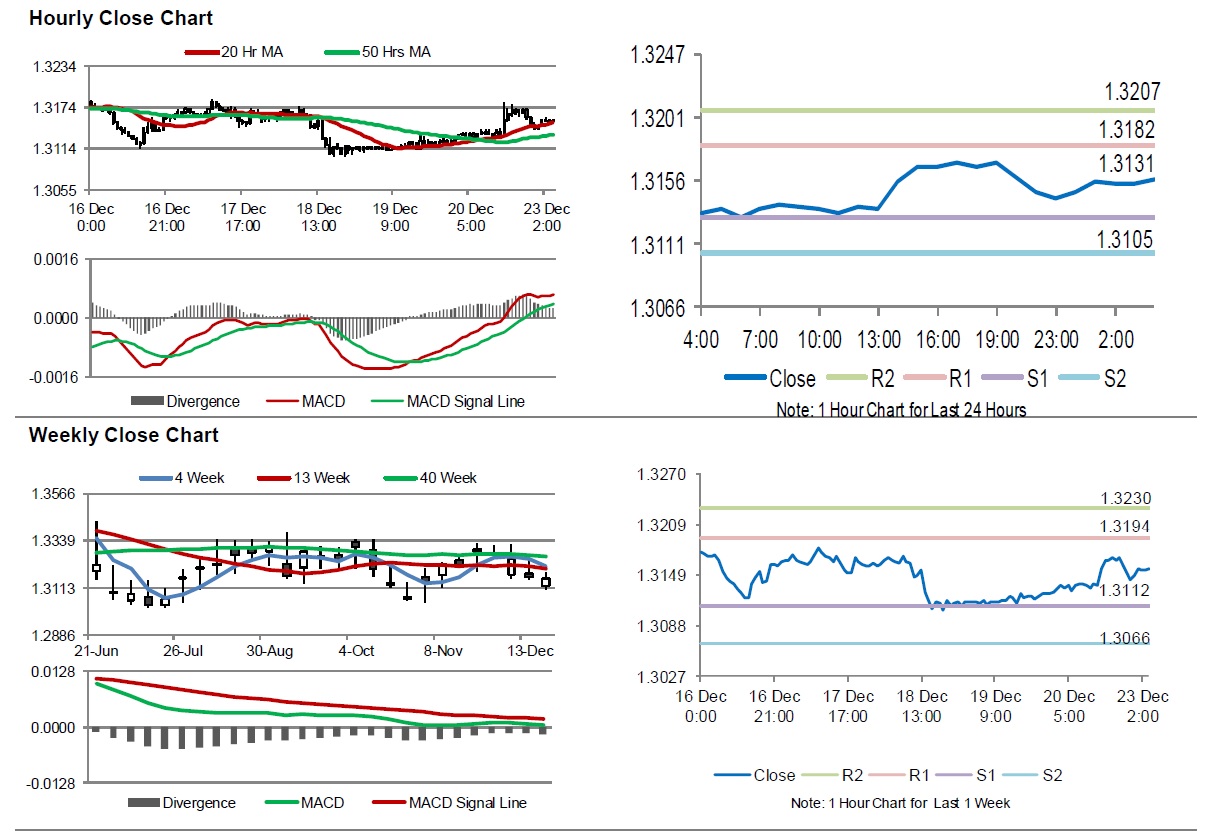

The pair is expected to find support at 1.3131, and a fall through could take it to the next support level of 1.3105. The pair is expected to find its first resistance at 1.3182, and a rise through could take it to the next resistance level of 1.3207.

Trading trend in the Loonie today, is expected to be determined by Canada’s gross domestic product for October, slated to release later in the day.

The currency pair is showing convergence with its 20 Hr moving average and trading above its 50 Hr moving average.