For the 24 hours to 23:00 GMT, the USD declined 0.17% against the CAD and closed at 1.3312 on Friday.

On the data front, Canada’s international merchandise trade deficit narrowed to CAD0.96 billion in August, following a revised deficit of CAD1.38 billion in the previous month. Market participants had anticipated the nation to post a deficit of CAD1.00 billion. Moreover, the nation’s seasonally adjusted Ivey PMI contracted to a level of 48.7 in September, more than market expectations for a fall to a level of 54.3. In the prior month, the PMI had recorded a reading of 60.6.

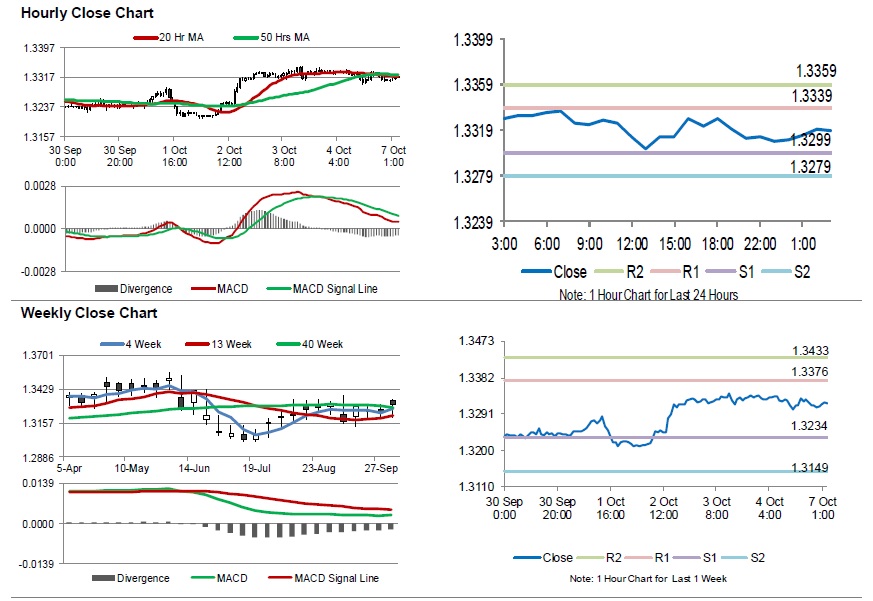

In the Asian session, at GMT0300, the pair is trading at 1.3319, with the USD trading 0.05% higher against the CAD from Friday’s close.

The pair is expected to find support at 1.3299, and a fall through could take it to the next support level of 1.3279. The pair is expected to find its first resistance at 1.3339, and a rise through could take it to the next resistance level of 1.3359.

The currency pair is showing convergence with its 20 Hr and 50 Hr moving averages.