For the 24 hours to 23:00 GMT, the USD declined 0.68% against the CAD and closed at 1.3658 on Friday.

The Canadian Dollar gained ground, after data revealed that Canada’s unemployment rate surprisingly fell to 6.5% in April, charting its lowest level in nine-years. In the previous month, the unemployment rate recorded a reading of 6.7%, while markets were anticipating for a steady reading. However, the nation’s net number of people employed increased less-than-anticipated by 3.2K in April, compared to a gain of 19.4K in the previous month.

In other economic news, the nation’s seasonally adjusted Ivey-PMI advanced to a level of 62.4 in April, compared to a level of 61.1 in the prior month.

In the Asian session, at GMT0300, the pair is trading at 1.3648, with the USD trading 0.07% lower against the CAD from Friday’s close.

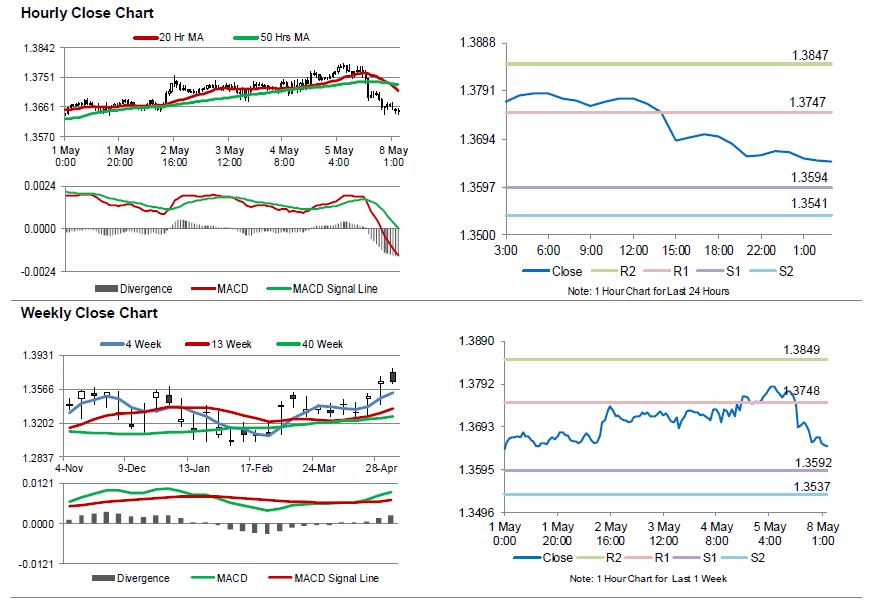

The pair is expected to find support at 1.3594, and a fall through could take it to the next support level of 1.3541. The pair is expected to find its first resistance at 1.3747, and a rise through could take it to the next resistance level of 1.3847.

Ahead in the day, traders will focus on Canada’s housing starts for April, scheduled to release in a few hours.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.