On Friday, the USD rose 0.23% against the CAD to close at 1.1212.

In economic news, Canada’s unemployment rate unexpectedly dropped to 6.8% in September, registering its lowest level in nearly six years, compared to a level of 7.0% recorded in the prior month. Market expectations were for the unemployment rate to record an unchanged reading of 7.0%. Additionally, the net number of people employed recorded an increase of 74.1 K in September, beating market expectations of an advance of 20.0 K jobs and following a fall of 11.0 K jobs in August. Meanwhile, the nation’s participation rate remained steady at 66.0% in September.

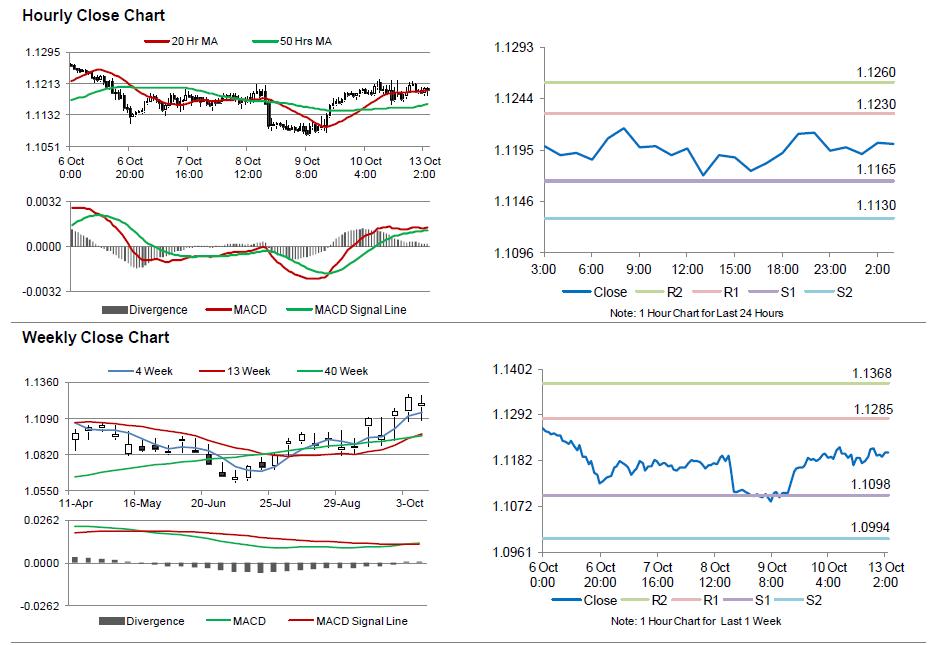

In the Asian session, at GMT0300, the pair is trading at 1.1201, with the USD trading 0.1% lower from Friday’s close.

The pair is expected to find support at 1.1165, and a fall through could take it to the next support level of 1.1130. The pair is expected to find its first resistance at 1.1230, and a rise through could take it to the next resistance level of 1.1260.

Trading trends in the CAD today are expected to be determined by global macroeconomic news.

The currency pair is showing convergence with its 20 Hr moving average and trading above its 50 Hr moving average.