For the 24 hours to 23:00 GMT, the USD declined 0.24% against the CAD and closed at 1.2539 on Friday.

Macroeconomic data revealed that Canada’s unemployment rate remained steady at a nine-year low of 6.2% in September, meeting market expectations. Further, the nation’s seasonally adjusted Ivey PMI surprisingly climbed to a level of 59.6 in September, confounding market expectations for a drop to a level of 56.0. The PMI had registered a reading of 56.3 in the previous month.

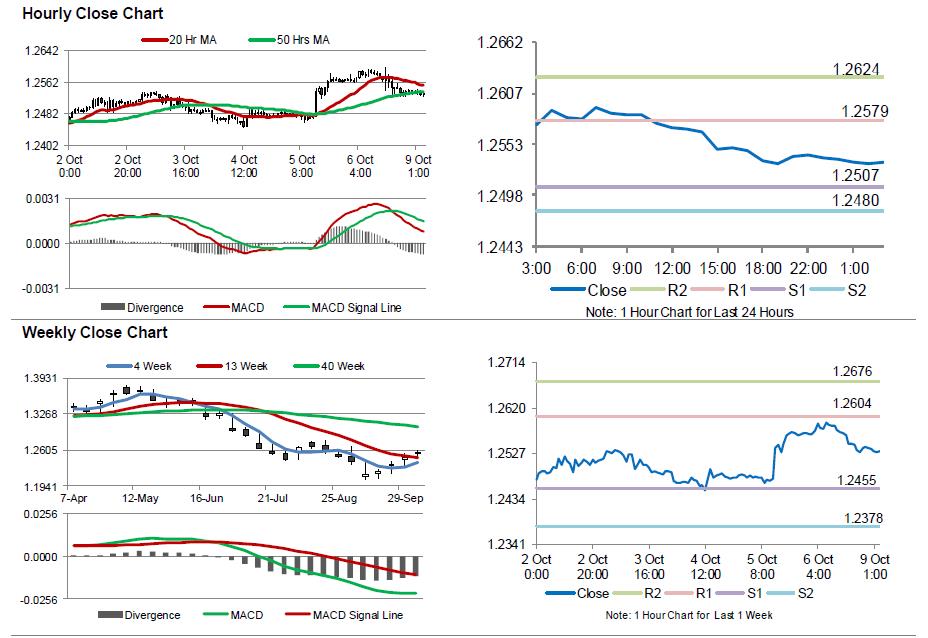

In the Asian session, at GMT0300, the pair is trading at 1.2533, with the USD trading a tad lower against the CAD from Friday’s close.

The pair is expected to find support at 1.2507, and a fall through could take it to the next support level of 1.2480. The pair is expected to find its first resistance at 1.2579, and a rise through could take it to the next resistance level of 1.2624.

Amid a holiday observed in Canada today, investors will focus on global macroeconomic events for further direction.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.